Beyond Meat ($BYND) Skyrockets Over 1,100% in 3 Days After Grandmaster-OBI’s Alert

From $0.72 to $8.85 — The Former WallStreetBets Mod Does It Again

Retail traders are stunned after Grandmaster-OBI, the former WallStreetBets moderator and lead analyst of the Making Easy Money Stock Market Alert Server, nailed yet another explosive breakout — this time in Beyond Meat (NASDAQ: $BYND).

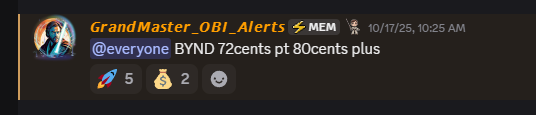

OBI alerted $BYND on October 17, 2025, for an entry price of just $0.72.

Only three trading days later, on October 22, the stock reached an intraday high of $8.85, marking an unbelievable +1,129% gain in less than a week.

🚀 How It Happened: The Meme ETF Trigger

Beyond Meat’s historic rally began when Roundhill Investments added the stock to its newly relaunched Roundhill MEME ETF (NYSE: MEME) — a thematic fund designed to track heavily shorted and socially trending stocks.

The inclusion set off a massive short squeeze, as more than 63% of Beyond Meat’s tradable shares were shorted before the announcement, according to data from FactSet cited by CNBC.

The result was one of the largest short-covering rallies of the year, with BYND shares jumping 127% on Monday and another 146% on Tuesday, before hitting OBI’s post-alert high of $8.85 on Wednesday.

⚡ Grandmaster-OBI’s Timing Was Perfect

Grandmaster-OBI’s alert on October 17 came before the stock’s ETF inclusion triggered mainstream momentum.

His Discord members entered early, right as technical signals indicated incoming volume pressure and elevated short exposure — a pattern he’s known for exploiting before news breaks.

In just three trading sessions, a $1,000 position at OBI’s alert price of $0.72 would now be worth approximately $12,300 at peak, a 12X return that adds another victory to his streak of high-accuracy alerts.

🧠 The Broader Story: ETFs, Short Interest, and Retail Power

Beyond Meat’s surge underscores how retail sentiment and ETF rebalancing can collide to create market explosions.

When Roundhill Investments reintroduced its MEME ETF earlier this month, few expected it to reignite the same speculative energy that defined the 2021 meme-stock era.

But with Beyond Meat’s extreme short interest and its new inclusion in the ETF, liquidity flooded in fast — forcing shorts to cover and retail momentum traders to pile in.

Roundhill’s move effectively transformed BYND into the latest symbol of retail-driven volatility, proving that ETF inclusion remains a powerful market catalyst when sentiment, short pressure, and speculation align.

💬 OBI’s Take

In his private Discord session Wednesday morning, Grandmaster-OBI told members,

“This setup was textbook — high short interest, underpriced retail chatter, and ETF rotation incoming. The key was to spot it before it hit CNBC.”

He added that more short-cover plays may be brewing, as thematic ETFs continue to reposition in volatile small-cap names.

🔥 What’s Next

Following back-to-back home runs with $PRAX (+430%), $APLM (+818%), $RANI (+247%), and now $BYND (+1,129%), Grandmaster-OBI is set to go live Monday, October 20, 2025, at 9:00 AM Central Time, for another round of real-time alerts and market analysis.

Given his recent track record, traders across X, Reddit, and Discord will be watching closely to see what he calls next.