FLASH RALLY: Grandmaster-Obi Drops SNTG Alert — 1-Hour +166% Blitz — Here’s the Tape and the Money Math

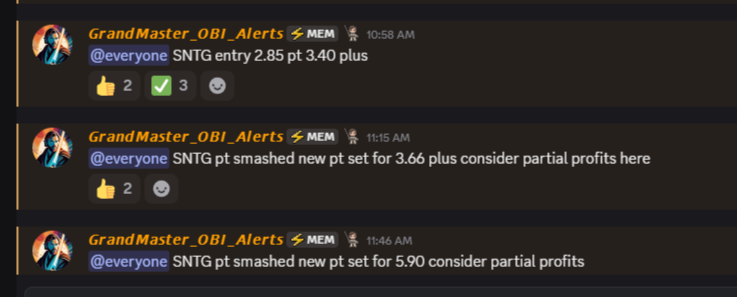

Retail trading went nuclear this morning after Grandmaster-Obi put Sentage (SNTG) on the radar at $2.85 (9/8/25, 10:58 AM). Within roughly one hour the stock rocketed to an intraday high of $7.59 — a blistering +166.3% move that lit up chats, screenshots and trading screens across Reddit, X and the M.E.M. feed.

If you like hard numbers, here’s the clean math and why this morning’s spike has already become another dramatic chapter in Grandmaster-Obi’s hot streak.

SNTG: the headline stat (exact math)

- Alert: $2.85 (9/8/25, 10:58 AM).

- Peak within ~1 hour: $7.59.

- Percent gain: (7.59 − 2.85) ÷ 2.85 = +166.32%.

- $1,000 scenario at peak (illustrative): $1,000 ÷ 2.85 ≈ 350.88 shares → 350.88 × $7.59 ≈ $2,663.17 (≈ $1,663 unrealized profit before fees/slippage/taxes).

That kind of intraday pop is exactly what sends screenshots viral and drives the next wave of new watchers into an alert stream.

The trendline — how today’s move stacks with his recent streak

To see why social feeds are combusting, look at the recent winners tied to the same alert flow:

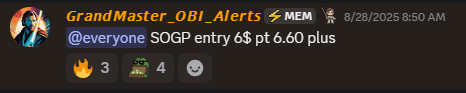

SOGP (Sound Group) — community-reported entry near $6.00 (Aug. 28). The name later printed intraday highs in the mid-$30s to $37 range — a +500%+ parabolic blast from the alert entry. Public historical pages captured SOGP’s extreme intraday range in early September.

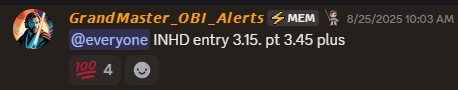

INHD (Inno Holdings)— alerted at $3.15 (8/25/25, 10:03 AM). On Sept. 8 the tape showed highs near $15.90, a +404.8% jump from the alert entry. That’s a multi-bagger in a single stretch.

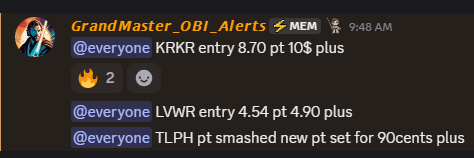

KRKR (36Kr) — pinged at $8.70 (9/8/25, 9:48 AM); intraday high reached $21.36 — about +145.5%. Historical quotes and intraday prints confirm sizable, fast moves in KRKR on Sept. 8.

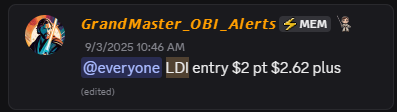

LDI (loanDepot) — flagged at about $2.00 on 9/3/25; by 9/8/25 it printed highs around $4.03 — roughly +101.5% from entry (public quote pages show the multi-session run).

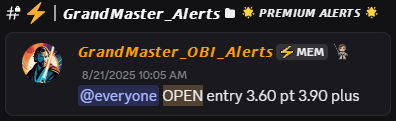

OPEN (Opendoor) — earlier-week alerts and macro flow pushed OPEN from low-$3s into the mid-$6s — an ~+85% swing from the alert levels observed in late August (covered widely across market pages).

Put plainly: these are not one-off lucky screenshots. They’re a cluster of high-variance, high-velocity tape moves that have followed the same structural pattern — and they’re exactly the reason new viewers flood the feed every time an alert is dropped.

What’s behind the moves — the “why” (plain English)

Traders who watch the microstructure say Grandmaster-Obi consistently hunts the same four signals:

- Borrow pressure / tight locates — when shorts are uncomfortable, covering risk increases.

- Unusual options flow — big call sweeps push market makers to buy underlying stock (gamma hedging).

- Low tradable float — limited shares amplify every incremental bid into outsized percent moves.

- A clean narrative or catalyst that retail can rally around — which accelerates FOMO and participation.

When those legs align, the tape can race — exactly what happened with SNTG this morning and with SOGP/INHD/KRKR earlier.

$1,000 snapshots — the visceral numbers that get shared

(These are peak-print illustrations — actual realized results vary by execution, slippage, commissions and timing.)

- SNTG: $1,000 → ~$2,663 at the $7.59 peak (≈ +166%).

- SOGP: $1,000 at $6 → ≈ $6,166 at a ~$37 peak (≈ +517%).

- INHD: $1,000 at $3.15 → ≈ $5,048 at $15.90 (≈ +405%).

- LDI: $1,000 at $2.00 → ≈ $2,015 at $4.03 (≈ +101.5%).

- OPEN: $1,000 at $3.70 → ≈ $1,852 at $6.85 (≈ +85%).

Those tables of “what $1k becomes” are why screenshots spread — but they’re also why risk controls matter.

Final — hype with a hard-nosed reality check

This morning’s SNTG pop (+166% in about an hour) is the textbook result of microstructure meeting viral flow. For traders who got in early, the payoff was real; for others, the lesson is execution, sizing and discipline.

If you’re watching the tape, remember: fast moves can reverse fast. Peak prints in chat are snapshots, not promises. Trade with a plan, define exits, and never risk more than you can afford to lose.

This article reports public market prints and community-shared alerts; it is informational only and not financial advice. Market data: Yahoo Finance, MarketWatch, Nasdaq and consolidated historical quotes. Always do your own research and consider consulting a licensed professional before trading.