Forget GME — Meet the Trader Quietly Beating Roaring Kitty’s Returns: HWH Explodes to $7.70, SOGP Rockets to $23

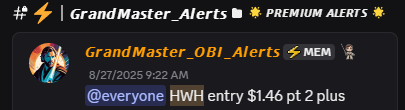

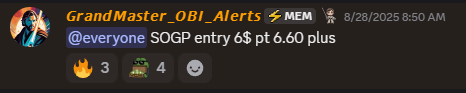

Retail feeds are literally exploding. In just a few trading sessions the alert maestro known online as Grandmaster-Obi has dropped two nails-on-the-head calls that lit the tape: HWH (HWH International) and SOGP (Sound Group). According to market prints, both names blasted through big intraday highs on Tuesday, Sept. 2 — the kind of moves that turn whispers into stampedes. Traders inside the M.E.M community and across social channels are posting fills, screenshots and shocked P&L snaps faster than moderators can pin them.

Below: the hard numbers, the trade mechanics that keep making Grandmaster-Obi’s alerts land, and concrete “what-if” money scenarios for anyone who caught these two calls.

The fast facts (price action & sources)

- HWH (alerted 8/27/25 at $1.46, per community posts) — intraday prints on Sept. 2 show a high into the upper single digits (the day’s range included a spike above $7; market data shows highs around $7.70–$7.77 on Sept. 2). That’s a multi-hundred percent surge in just days.

- SOGP (alerted 8/28/25 at $6.00, per community posts) — official historical intraday data lists a Sep. 2 high above $23 (the consolidated intraday high on Sept. 2 was ~$23.20), a parabolic sprint from late-August levels.

(Price prints vary slightly by venue and timestamp; the cited market pages capture the consolidated tape and public historical highs for Sept. 2, 2025.)

Raw percent gains — the numbers that make people shout

- HWH: from $1.46 → $7.70 = ((7.70 − 1.46) / 1.46) × 100 ≈ +427.4%.

- SOGP: from $6.00 → $23.20 = ((23.20 − 6.00) / 6.00) × 100 ≈ +286.7%.

Those are the headline snaps traders are sharing — explosive, fast, and the kind of returns that flip conversations about “what if” into screenshots of realized gains.

What $1,000 would look like (peak-print scenarios)

(Important: these are peak-intraday math examples — actual fills, slippage, commissions and taxes will change real results.)

- HWH scenario — $1,000 at $1.46 → ~684.93 shares → at $7.70 ≈ $5,274.62 (profit ≈ $4,274.62).

- SOGP scenario — $1,000 at $6.00 → ~166.67 shares → at $23.20 ≈ $3,866.67 (profit ≈ $2,866.67).

Those hypothetical outcomes are exactly why screenshots of fills cascade across Discord—small stakes can become life-changing swings when a low-float, catalyst-driven name goes parabolic.

How these setups happen — the “Obi pattern” (plain English)

Grandmaster-Obi’s alerts don’t read like random hot takes. Traders who follow his feed point to a repeatable checklist:

- Borrow pressure: locates/borrow fees climb — shorts get squeezed on carrying costs.

- Options and flow: concentrated call activity or block trades trigger market-maker hedging, which forces buys in the underlying (gamma fuel).

- Tight free float: limited available shares mean ordinary buy orders move price exponentially.

- A clean narrative/catalyst: earnings beats, regulatory news, macro headlines or simply a viral social narrative that pulls in retail buyers.

When those four checkboxes light up — as they allegedly did for HWH and SOGP — the result is a two-to-three-day blast that can double, triple, or more. Members across M.E.M report seeing the same signals flashing in the minutes and hours before the moves.

Why the noise is global — and why members say it works

A few reasons the reactions are so loud:

- Speed: Alerts are pushed live with screenshots of the data that triggered them (borrow reads, option sweeps, unusual volume). Real-time delivery is everything.

- Repeatability: This isn’t a one-hit wonder. The same microstructure signals and execution playbook have shown up across many of his past winners, building a public trail of pings and outcomes.

- Social verification: Members post time-stamped fills and P&L screenshots, creating a visible feedback loop that amplifies trust — and attracts more traders who want the same edge.

That combination — data + speed + visible results — is what turns a single alert into a stampede of participation.

A quick reality check (don’t ignore this)

For every screenshot of a perfect fill, there are traders who missed the peak, took worse fills, or got stopped out on the snapback. Micro-cap squeezes are high variance — they make fortunes fast and erase them faster. If the borrow eases, option flows cool down, or news reverses sentiment, a vertical move can unwind just as quickly.

So yes: the upside is dramatic. So is the downside. Trade sizing, exits and risk discipline separate the few who bank gains from the many who only post “what if” screenshots.

The community angle — what the headlines don’t show

Grandmaster-Obi’s public footprint (YouTube and X) and the M.E.M Discord listing make it easy to see how much attention his calls draw. The server and social channels light up every time an alert hits the tape, accelerating both the move and the social proof. Whether you treat those screenshots as gospel or entertainment, they’re altering how retail discovers and reacts to market stress points.

Final — why this day will be bookmarked in retail trading feeds

HWH and SOGP’s epic runs are a reminder of what happens when microstructure meets momentum: rapid borrowing pain for shorts, frantic dealer hedging, and retail piling in behind a simple story. For traders who caught the calls at the right time, the math is jaw-dropping. For everyone else, it’s an education in how modern retail flow, options gamma, and a thin float interact to produce headline events.

If you saw the fills, you already know why the message boards are frying. If you didn’t, today is the textbook — and the tape will teach faster than any newsletter.

This article reports on public market prints and widely shared community alerts. Price sources: consolidated market data and historical intraday records for Sept. 2, 2025. See market pages for HWH and SOGP for intraday ranges and historical highs.

Not financial advice. Momentum and short-cover trades carry significant risk of loss. Always do your own research and consult a licensed professional before trading.