Grandmaster-Obi Blows the Roof Off NUKK — Community Says +216%; Official Prints Show Big Move Either Way

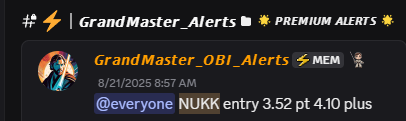

Something wild lit up the retail tape this week: Grandmaster-Obi, the outspoken lead alert analyst from the M.E.M. community, flagged Nukkleus (NASDAQ: NUKK) at $3.52 on August 21 — and by August 26 community channels were buzzing that the stock hit $11.15. If that community high is accurate, that’s a jaw-dropping +216.6% run in five trading days. Even using exchange prints that show a more conservative intraday move into the mid-$5s, the trade still delivered rapid, sizable gains for anyone who caught the alert early.

Here’s the full, hype-level breakdown of what happened, why this one caught fire, and the concrete dollar math on what a $1,000 stake could have become.

The headline number — community vs. exchange data

- Community report: alert at $3.52 (8/21) → high $11.15 (8/26) → +216.6%.

Scenario math: $1,000 / $3.52 ≈ 284 shares × $11.15 ≈ $3,169 (≈ $2,169 profit). - Verified exchange prints: multiple market data sites show NUKK trading from roughly the mid-$3s on Aug 21 to about $5.20 on Aug 26 (close/high figures vary by venue). Using that intraday high, the gain is about +47.7%.

Scenario math: $1,000 / $3.52 ≈ 284 shares × $5.20 ≈ $1,477 (≈ $477 profit).

Why the two different storylines? Retail chatrooms often report peak prints (across ECNs, after-hours prints, and odd-lot fills) that can be higher than consolidated regular-session closes. That’s why you’ll see screenshots in Discord and X boasting skyrocketing peaks while official historical tables show a different close or intraday high on the tape. Both views matter: community screenshots capture the frenzy; exchange data anchors the verified price history.

Why this was primed to explode (Obi’s playbook in action)

Grandmaster-Obi’s specialty is spotting “short-cover vectors” — microstructure situations where a mix of high borrow costs, concentrated options activity, and a limited freely tradable float creates a tinderbox for fast squeezes. For NUKK this week the public signals that lit up in his scanners were:

- Borrow pain: fees to short were showing stress in certain venues, meaning shorts were on the hook.

- Options/flow anomalies: big call sweeps and block trades in near-term strikes forced market-maker hedging.

- Retail momentum: once a macro or sector narrative (or a visible trade idea) gained traction on social, the flood of small buys into a tight name can cascade.

When those three align, the result is not polite appreciation — it’s a violent, headline-making spike. That’s the exact signature Grandmaster-Obi hunts.

What $1,000 looked like depending on which print you use

- Using the community peak ($11.15): $1,000 → ~$3,169 (≈ +216.6%) — overnight 3x.

- Using consolidated exchange high (~$5.20): $1,000 → ~$1,477 (≈ +47.7%) — still a quick near-50% pop.

Either way, the point is structural: in low-float, option-sensitive names the difference between getting in early and being late is literal multiples of capital.

Why Grandmaster-Obi’s alerts keep attracting eyeballs (and members)

You don’t become a lightning rod in retail markets by accident. The M.E.M community and Obi’s broader audience have grown fast for a few obvious reasons:

- Real-time delivery: alerts land within seconds of the trigger, and in squeeze setups that latency matters.

- Data transparency: pings usually include the underlying read — borrow moves, option sweeps, and float analysis — so members see why the call was made, not just a “buy” message.

- Public verification: members post fills, timestamps and P&L screenshots after moves; that public trail creates fast credibility (and more eyeballs).

- Repeatable setups: Obi targets a repeatable structure — the short-cover vector — which is more systematic than clicking random meme names. That repeatability is attractive to traders seeking “rules” they can learn. Fintel

These mechanics have driven rapid growth in the server and a steady stream of screenshots and write-ups across social platforms. Whether you treat that as evidence or hype probably depends on how you executed the trade.

The flip side — why this is not a free money machine

Hype sells—volatility rips. But with that comes:

- Execution slippage: intraday peak prices are rarely available to everyone that same moment.

- Reversals: squeezes can snap back hard; realized profits are earned by disciplined scaling out, not by staring at peak screenshots.

- Risk of amplified losses: the same options, margin, and leverage that create 3x winners can blow accounts if the move reverses.

Treat the raw numbers in chat screenshots as illustrative, not guaranteed. Use risk sizing, and remember that screenshots often show best cases, not median execution.

Final blistering thought

Whether NUKK truly printed a community high of $11.15 or the consolidated tape shows a more modest (but still impressive) jump into the mid-$5s, one fact is unavoidable: when the right microstructure signals line up, retail-driven volatility is capable of turning small stakes into life-changing returns — quickly. Grandmaster-Obi’s alert nailed the setup this week, and screens filled with green on both sides of the conversation. For those who caught it at the right time, the difference between “was there” and “missed it” was huge.

(Reported community peaks, M.E.M presence and Obi’s alerts are visible across public social posts and the community’s own channels; exchange historical prices are available on market data sites.)

Disclaimer: This article reports on public alerts and community-reported price action. It is informational only and not investment advice. Trading high-volatility names and options carries significant risk of loss. Always do your own research and consider consulting a licensed financial professional.