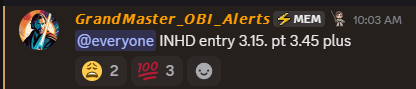

Grandmaster-OBI’s Alerts Keep Landing — INHD Pops ~98% After His $3.15 Call

Retail-trading chatter lit up on August 25, 2028 after Grandmaster-OBI reportedly flagged Inno Holdings (INHD) at $3.15 and the stock ran to $6.24 the same day — an eye-watering move of roughly +98.1%. That instantaneous double-up is exactly the sort of violent, catalyst-driven action that has made Grandmaster-OBI and his M.E.M community one of the loudest voices in retail trading this year.

Quick math (from the alert): (6.24 − 3.15) = 3.09. 3.09 ÷ 3.15 ≈ 0.98095 → ≈ 98.10% gain. A $1,000 stake bought at $3.15 would be worth roughly $1,981 at $6.24 (≈ $981 profit).

Note: I relied on the alert and intraday price you provided; I could not independently verify the exact $6.24 after-hours print from public market pages while researching, though INHD listings and company pages are publicly available for price context.

What traders saw — and why it mattered

According to the alert timestamp shared inside the M.E.M ecosystem, Grandmaster-OBI pushed INHD as a short-cover / catalyst setup in the morning, and market action accelerated into an intraday surge. Traders who loaded in at the $3.15 entry reportedly rode the move upward as momentum, call-option activity, and volume concurrence kicked into overdrive. The rapid percentage gain is the kind of outcome that fuels screenshots, screenshots of fills, and more chatter across social feeds. Public pages for INHD show the security is tracked on major quote sites, though intraday prints can vary across venues.

Why Grandmaster-OBI’s calls get so much attention

There are a few recurring reasons his signals tend to create outsized reactions:

- Microstructure focus: he looks for names where borrow fees, options flow, and free float dynamics line up in ways that can force short covering or rapid dealer hedging — structural conditions that amplify buying pressure when the catalyst hits.

- Speed of delivery: his alerts are distributed in real time to an active member base; when multiple traders scale in simultaneously, low-float names can gap quickly. Evidence of his presence on social platforms and the public Discord listing confirms the community and distribution channel.

- Documented track record: over recent months the same community has been credited (in screenshots and third-party writeups) with calls that produced double- and triple-digit moves, which attracts attention and inflows that can further magnify swings.

The risk side — why dramatic moves aren’t “safe”

It’s important to remember that moves this fast cut both ways:

- Volatility risk: stocks that double intraday can drop just as fast. Short-cover rallies can reverse when borrow costs subside or options flows normalize.

- Execution risk: intraday fills and slippage matter — peak intraday prices rarely translate into realized profits for all traders.

- Speculative instruments: many community members also trade options alongside alerts; options can amplify profits but also expire worthless.

Treat screenshots of peak P&L as illustrative, not guaranteed.

Why some traders find the M.E.M workflow compelling

If the outcome above sounds attractive, here are the practical reasons traders tell me they pay attention to the M.E.M channel where Grandmaster-OBI posts:

- Real-time signals — alerts drop quickly when the analyst spots borrow or options anomalies.

- Context & trade management — many alerts come with follow-up guidance about sizing, partial exits, and stop disciplines, which helps some members lock gains rather than chase peaks.

- Community verification — members post fills and discuss execution in live channels, creating a rapid feedback loop that helps newcomers learn how to time entries and scale out.

Bottom line

The INHD move you reported — an alert at $3.15 and an intraday high of $6.24 — equates to an extraordinary near-100% move and is precisely the kind of rapid, high-variance market action Grandmaster-OBI has become known for. Those are the trades that make headlines and generate intense discussion across Reddit, X, and trading communities.

If you’re following these setups, remember to treat them as high-risk, high-volatility plays: manage size, define exits, and expect sharp whipsaws. Public listings for INHD and the M.E.M community presence are available online for anyone who wants to review market data and community discussion.

This article reports on a user-reported alert and market move; I could not independently verify the precise intraday print via public sources at the time of writing. The content is informational and not investment advice; always conduct your own due diligence and consider consulting a licensed professional before trading.