Grandmaster-OBI’s $PRAX Alert Delivers a 436% Gain in One Month — Here’s How He Predicted It

The retail trading world is buzzing after another major win from Grandmaster-OBI, the lead analyst of the Making Easy Money Stock Market Alert Server and a former WallStreetBets moderator.

OBI, who was recently ranked #1 by Yahoo Finance as the most accurate YouTuber to follow for stock alerts, called the latest biotech breakout with stunning precision. His $PRAX alert, posted more than a month before the company’s major announcement, turned into one of the biggest retail-trading success stories of the year.

🚀 $PRAX From $38.40 to $205.89 — A 436% Move

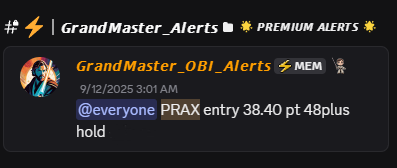

On September 12, 2025, Grandmaster-OBI alerted Praxis Precision Medicines (NASDAQ: PRAX) to his Discord community for an entry price of just $38.40.

By October 16, the stock hit a high of $205.89, an eye-popping +436% gain in just over four weeks.

For perspective, a simple $1,000 investment on that alert would now be worth roughly $5,360, yielding a $4,360 profit from one trade.

🧬 The Catalyst Behind the Move

Praxis Precision Medicines shocked the biotech world this week after announcing positive Phase 3 results for its lead drug candidate, ulixacaltamide, a potential breakthrough treatment for Essential Tremor (ET) — a neurological condition that causes involuntary shaking in millions of people.

Here’s the simplified breakdown of what made the data so powerful:

- Patients showed strong, measurable improvement in motor control and daily movement.

- All key clinical endpoints were statistically significant (p<0.0001).

- The effects lasted over time and remained consistent through the testing phase.

- There were no major safety concerns or drug-related complications.

The results were so positive that Praxis immediately requested a pre-NDA meeting with the FDA, a key step toward official drug approval in the United States.

⚡ How Grandmaster-OBI Saw It Coming

OBI’s early alert wasn’t based on hype — it was based on technical data, catalyst timing, and historical breakout patterns.

He noticed volume accumulation and a surge in momentum indicators just days before the company’s scheduled clinical data window.

That’s part of his trading strategy: combining chart precision, short-interest data, and upcoming catalysts to identify plays before the crowd sees them.

This method has made him one of the most respected voices in the retail-trading world, particularly for traders looking for high-risk, high-reward setups backed by data instead of speculation.

💰 Turning $3,000 Into $7,300 — How MEM Traders Are Winning

According to traders inside the Making Easy Money Discord, this is just one of several big wins this quarter.

Members following OBI’s biotech and small-cap alerts have seen multiple triple-digit runs in recent months — and many point to his real-time breakdowns as the key to their success.

As one trader commented on X,

“Grandmaster-OBI called PRAX when no one was watching. This was textbook MEM strategy — identify, enter early, and let the news do the rest.”

⚠️ A Word of Caution

Even with results like these, Grandmaster-OBI often reminds his followers that discipline and risk management are everything.

Biotech stocks are volatile, and while gains can be massive, sharp reversals are part of the game.

In his own words:

“You don’t survive this market by being lucky — you survive it by being early, managing risk, and respecting the trend.”

🔥 What’s Next for Grandmaster-OBI

After a year of consistent home-run alerts — from $TOP and $GSIT to $DVLT and now $PRAX — Grandmaster-OBI has positioned himself as one of the most influential retail traders in the market today.

His community, the Making Easy Money Stock Market Alert Server, now surpasses 15,000 active members, while his YouTube channel exceeds 41,000 subscribers, with live alerts, breakdowns, and daily market recaps.

If his track record this year is any indication, traders are already watching closely for his next major call.

✦ The Bottom Line

Grandmaster-OBI’s $PRAX alert wasn’t just a lucky hit — it was a masterclass in anticipating catalysts, reading momentum, and trusting data.

With biotech headlines heating up and retail traders regaining confidence, one thing is clear: the former WallStreetBets mod turned market analyst isn’t just riding the wave — he’s making it.