Hedge Funds Hate Him — Retail Loves Him: The New Squeeze Maestro

Grandmaster-Obi’s streak shows no signs of cooling off. In a new video released this week he framed Sound Group (SOGP) as a “potential RGC-style” short-cover setup — and the market answered: SOGP ran to ≈$37 on Sept. 5, 2025, after community pings put the name on retail radars.

Below is a blow-by-blow on the three biggest plays he’s been credited with this week (SOGP, INHD and OPEN), how big the moves were in percentage terms, what a $1,000 stake at each alert would have looked like at the intraday peaks, why he thinks SOGP could follow RGC’s path, and the real risks behind these kinds of fast squeeze trades.

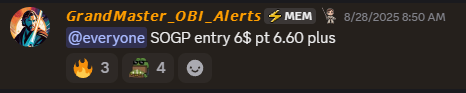

SOGP: the headline grabber — $6.00 → $37.00 (reported) — ≈+516.7%

- Alert (community-reported): ~$6.00 (Aug. 28, 2025).

- Reported intraday high: ~$37.00 on Sept. 5, 2025.

- Percent gain: (37.00 − 6.00) ÷ 6.00 = +516.67%.

- $1,000 scenario (illustrative): $1,000 ÷ $6.00 = 166.67 shares → 166.67 × $37.00 ≈ $6,166.67 (≈ $5,166.67 unrealized profit before fees, slippage, taxes).

In his recent video, Grandmaster-Obi explained why SOGP’s microstructure — rising short-borrow pressure, concentrated options activity, and a compact free float — looks like the same four-factor stack that presaged rapid moves in his RGC call. He promised a fresh SOGP price target in a follow-up update. (Video and channel posted publicly).

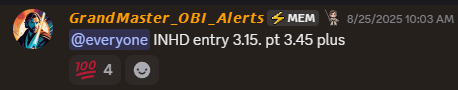

INHD: from pennies to a triple-digit pop — $3.15 → $11.69 — ≈+271.1%

- Alert (community-reported): $3.15 (Aug. 23, 2025).

- Intraday high (reported Sept. 5, 2025): $11.69.

- Percent gain: (11.69 − 3.15) ÷ 3.15 = +271.11%.

- $1,000 scenario: $1,000 ÷ $3.15 ≈ 317.46 shares → 317.46 × $11.69 ≈ $3,712.70 (≈ $2,712.70 unrealized profit).

Community chatter shows rapid fills and quick exits for many early entrants — the sort of intraday math that attracts screenshots and new followers.

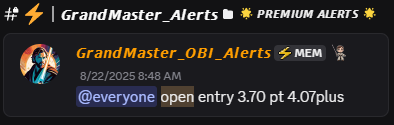

OPEN: a steadier, macro-driven winner — $3.70 → $6.85 — ≈+85.1%

- Alert (community-reported): $3.70 (Aug. 22, 2025).

- Intraday high (Sept. 5, 2025): $6.85.

- Percent gain: (6.85 − 3.70) ÷ 3.70 = +85.14%.

- $1,000 scenario: $1,000 ÷ $3.70 ≈ 270.27 shares → 270.27 × $6.85 ≈ $1,851.85 (≈ $851.85 unrealized profit).

OPEN’s move was widely tied to a dovish macro narrative that lifted rate-sensitive housing names; Grandmaster-Obi layered the macro story on top of micro signals when he flagged the name.

Why he’s comparing SOGP to RGC — and why that matters

Grandmaster-Obi explicitly compared SOGP’s structure to Regencell (RGC) in recent commentary — not claiming guaranteed repeats, but arguing that the same mechanics are present: tight float, buy-flow in options, sharp borrow pressure and a catalyst that draws retail attention. RGC’s 2025 saga (including a 38-for-1 stock split and extreme post-split volatility) became a benchmark for what coordinated microstructure + retail mania can produce; media coverage documented the split and the subsequent parabolic moves.

That historical RGC episode is why a serial signal-streamer who times microstructure well gets headlines when he calls something “RGC-like.”

How he finds these trades (the repeatable checklist)

According to his public breakdowns and the patterns community members post, he looks for a consistent four-point alignment before sending an aggressive alert:

- Borrow/locate stress — rising costs or drying locates that punish shorts.

- Odd options activity — concentrated call sweeps that force dealers to buy underlying stock (gamma hedging).

- Tight tradable float — a small freely tradable share base that amplifies price moves.

- A clear catalyst or narrative — macro news, sector momentum, or a simple story retail can rally behind.

When those elements line up, the probability of a fast short-cover wave — rather than a slow drift — increases.

What this means for traders and why the community swells

- Speed matters: alerts are delivered in real time; in a squeeze the first minutes are crucial.

- Visible receipts: members routinely post time-stamped fills, creating a public track record that fuels social proof and fresh inflows.

- Repeatability vs. romance: unlike the single-name romance of some past influencers, Grandmaster-Obi’s feed is serial — multiple, teachable setups — which appeals to traders who want a playbook, not a manifesto.

That combination explains the surge in chatter around his calls and why retail networks amplify each successful ping.

The inevitable caution — this is high-variance, not guaranteed

A final, essential point: these snapshots are not guarantees. Intraday peak prints are snapshots; realized fills, slippage and execution quality vary greatly across brokers and order types. Short-cover and gamma-driven rallies can reverse sharply if borrow eases, option flow fades, or the narrative collapses. Treat hypothetical $1,000 scenarios above as illustrative peak-print math, not a promise of realized returns. Always size positions and predefine exits.

Bottom line

Grandmaster-Obi’s SOGP call ripped into the high-$30s on Sept. 5 — a move that, when stacked against his INHD and OPEN alerts the same week, paints a portrait of a signal operator who keeps surfacing structurally similar setups across sectors. Whether SOGP ultimately “finishes” a full RGC-style run or simply hands early entrants another multi-bagger, the playbook he’s using — borrow stress + options flow + tight float + a clean narrative — is clear and repeatable in form, if not in outcome.

This article reports on public market prints, community-reported alert timestamps, and Grandmaster-Obi’s publicly posted video commentary. It is informational only and is not financial advice. High-volatility trading and options carry a significant risk of loss; always do your own research and consider consulting a licensed professional before trading.