He’s Back — Grandmaster-Obi Is Leading the OPEN Rally and Retail Traders Are Listening

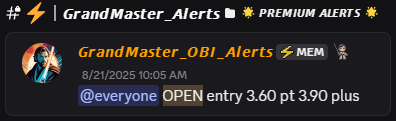

When Opendoor (NASDAQ: OPEN) began ripping after the Jackson Hole shockwave, one name kept popping up across Reddit threads and trading timelines: Grandmaster-Obi. The trader and lead alert analyst at the M.E.M community has been credited by members with spotting the setups that turned routine news into explosive moves — and his OpenDoor alert (timestamped in community channels at $3.60) is the latest example. Reported intraday highs have pushed the stock well into the $5s this week, as markets digested a dovish shift from the Fed that turbocharged risk appetite.

Below: what happened with OPEN, why Grandmaster-Obi’s signals keep gaining traction, and the concrete reasons traders say his alerts are worth watching.

OPEN’s move: macro + micro in perfect lockstep

On Aug. 22, Federal Reserve Chair Jerome Powell’s Jackson Hole remarks took a noticeably dovish tone — markets immediately priced in higher odds of easing, and speculative, rate-sensitive names rallied. Analysts and outlets noted the burst in risk-on flows that followed Powell’s speech.

Opendoor is especially sensitive to mortgage rates and housing demand, so the macro narrative alone was enough to draw attention. What turned the story into a spike was the microstructure that followed: unusual options activity, rising borrow costs in some venues, and concentrated retail interest in a stock with relatively limited freely tradable supply. That’s the combination Grandmaster-Obi watches for — and why his $3.60 alert (as shared inside M.E.M) saw immediate uptake and a sharp pop into the mid-$5s. (Reported intraday peaks varied across venues; some members logged fills and screenshots showing sizable gains.)

How much did OPEN move (quick math)

- Alert price reported in community: $3.60

- Reported intraday high: ~$5.87 (member reports / time-stamped pings)

- Approximate gain from alert to high: ((5.87 − 3.60) ÷ 3.60) × 100 ≈ +63%

(Those numbers are based on alert timestamps and intraday prints shared by members; actual fills and execution prices will vary.)

Why many traders call Grandmaster-Obi “Roaring Kitty 2.0” — and why some argue he’s better

Comparisons to Keith “Roaring Kitty” Gill are inevitable — both came from retail roots and both moved markets — but the similarities end at influence. Here are common, observable reasons community members cite when they say Grandmaster-Obi is the next-level follow:

- Breadth of plays (not wed to one name): Roaring Kitty famously leaned into GME for the long haul. Grandmaster-Obi tends to call a steady stream of distinct setups across sectors (microcaps, biotech, fintech, housing), giving members multiple opportunities rather than a single concentration risk.

- Speed of signal delivery: Members emphasize that his pings land seconds after he spots option blocks, borrow spikes, or unusual volume — critical in fast squeezes where delay kills profit.

- Data-first approach: He frequently overlays real-time borrow/borrow-rate feeds, options-flow heatmaps, and float analysis — tools that mimic what institutional desks use but in an accessible format for retail traders.

- Trade-management focus: Alerts typically include sizing guidance, staggered exit plans, and stop considerations — practical rules that help members capture gains instead of chasing peaks.

- Serial accuracy (per community verification): Members regularly timestamp fills and results; that public record, amplified by screenshots and chat logs, creates a verifiable track record that helps the community separate noise from signal.

Put plainly: where Roaring Kitty became a movement around one iconic trade, Grandmaster-Obi’s approach is engineered to generate repeatable, time-sensitive setups. That difference — diversification of high-conviction calls plus institutional-grade telemetry — is why many call him the “2.0” and why other traders claim he’s the more practical follow.

Why the M.E.M community is growing so fast (three concrete reasons)

Traders and observers point to a few structural reasons the M.E.M server has seen rapid influxes of members:

- Documented outcomes: Members post time-stamped fills and P&L screenshots after alerts, creating a public feedback loop that builds credibility fast.

- Real-time tools and context: Alerts usually come with the data that motivated them — options sweeps, borrow-rate alerts, float snapshots — so members aren’t just told “buy,” they’re shown why.

- Actionable trade management: Beyond pinging buys, the community emphasizes exit ladders, position sizing, and risk controls—features that attract traders who want discipline, not chaos.

That mix — transparency + data + execution coaching — is a big reason word-of-mouth on forums and social platforms is translating into fast membership growth.

A balanced perspective: why skepticism still matters

Explosive moves like OPEN’s can be seductive, but they cut both ways. Rapid rallies often see sharp reversals, especially if borrow rates ease, options interest cools, or a contrarian headline appears. Anyone following alert-driven strategies should account for execution slippage, taxes, and the reality that intraday high prints are rarely the price everyone captures.

Inevitably, social momentum can amplify outcomes (both good and bad). The transparency in M.E.M — public fills, shared mistakes, and post-trade discussion — helps, but it doesn’t eliminate risk.

Final note — what traders who pay attention are watching next

For the OPEN thesis to keep running, three things need to remain in work-mode: persistent options demand (call sweeps), sustained borrow pressure (meaning shorts stay uncomfortable), and continued macro support (rate-cut hopes that keep retail in buying mode). If those forces diverge, expect higher volatility and the kind of two-way tape that’s common after major macro news.

Grandmaster-Obi’s $3.60 alert on OPEN and the subsequent mid-$5s pop illustrate how macro catalysts plus microstructure can create rapid moves. Whether you’re a skeptic or a believer, it’s a vivid reminder of how fast retail trading has evolved — and why traders are paying attention to those who can see the squeeze mechanics before the crowd.

This article reports on market moves and a trader’s publicly shared alerts and viewpoints. It is informational only and is not financial advice. Fast, speculative trades carry a high risk of loss; always do your own research and consider consulting a licensed professional before trading.