He’s Back — The “Short-Cover Whisperer” Lights Opendoor Fuse: Alerted $OPEN at $3.60, Says $7 Is Next After Powell Shockwave

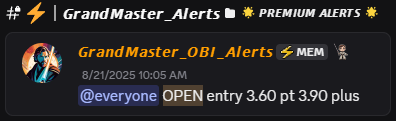

Grandmaster-Obi lit up market threads this weekend when he alerted Opendoor (NASDAQ: OPEN) at $3.60 on August 21, and the stock ripped into the mid-$5s the following day. With Federal Reserve Chair Jerome Powell’s unexpectedly dovish Jackson Hole remarks stoking a broad risk-on rally, Grandmaster-Obi doubled down on camera — saying a short-cover wave could carry OPEN toward $7 this week, and even handing viewers a speculative call option idea to play the move.

This is the kind of string-pulling that has social media asking the same question over and over: how does he keep finding these plays — and faster than anyone else?

Grandmaster-Obi's $OPEN latest Video

J-Pow, the Spark — Markets Reacted, OPEN Ignited

On August 22, Powell’s Jackson Hole talk injected fresh rate-cut hopes into markets, softening Treasury yields and fueling broad rallies. Traders interpreted his language as a move toward looser policy if labor-market weakness continues — and the market rallied accordingly. Reuters captured the market reaction to Powell’s tone and the surge in risk assets.

Opendoor, a company whose fortunes are highly sensitive to mortgage rates and housing activity, was an immediate beneficiary: shares jumped sharply after the Powell remarks, as investors began pricing in easier financing and a thawing housing cycle. Coverage of OPEN’s bullish move noted the surge and linked it to the Fed’s dovish tilt.

The Alert: $3.60 → $5.27 (Then Eyes on $7)

According to the alert, the analyst called Opendoor at $3.60 on Aug 21, citing a constellation of signals: jump-in borrow fees, unusual call-option activity, and a thin float vulnerable to a short-cover wave. After Powell’s remarks, retail buyers flooded in and the tape lit up—prices spiked into the mid-$5s on Aug 22 (the user reports an intraday high of $5.27). In his video post-run, he argued that Friday’s short-sale behavior and the dovish macro narrative could create a feedback loop of speculative retail buying plus forced short covering that would push OPEN toward $7.

He didn’t stop there: at the tail end of the video he dropped a specific call-option idea for players who want asymmetric upside if the short-cover thesis accelerates before expiry. (That trade idea — high risk, high reward — is exactly the sort of speculative instrument that explodes in a short-cover environment.)

Why This Setup Can Become a Short-Cover Wave (Not Just Another Meme Pump)

A short-cover wave often differs from pure retail mania in three technical ways — and this setup checked the boxes:

- Borrow Costs Climbing: When the fee to borrow shares spikes, institutional short positions suddenly become expensive to hold, increasing pressure to buy shares and close positions.

- Options-Market Gamma: Heavy call buying forces market-maker hedges that require buying the underlying shares, which amplifies upward momentum.

- Retail Speculation Timing: A macro catalyst (Powell) moves the crowd, and that crowd’s buying pressure hits a low-float name where shorts are already pressured. The result: a self-reinforcing loop of retail buying + short covering.

Combine those three and a name like Opendoor — which benefits from the prospect of lower rates — turns into a magnet for fast, violent moves.

The Social Echo Chamber: Tweets, Memes, and Momentum

The commentary spilled onto social platforms immediately. High-profile crypto-and-market voices celebrated the rate-cut signal and connected the dots to housing plays. Prominent commentators amplified the message that lower rates could “unfreeze” parts of the housing market — a narrative that traders used to justify speculative buys in OPEN ahead of any fundamental confirmation. Coverage and commentary highlighted how sentiment can coalesce into a true catalyst in minutes.

The Caveats (Because This Is Fast, Not Free Money)

This is exactly the kind of environment that makes for dramatic winners — and rapid reversals. Short-cover waves can reverse if: borrow costs drop quickly, options interest rolls off, or a negative news item punctures retail conviction. Options recommended in a video are speculative by design; they can explode in value or go to zero. Anyone following such a call should size positions with that risk in mind.

Why Traders Keep Watching Him

Observers point to a few recurring reasons why his alerts land with uncanny timing:

- Data-first timing: He watches real-time borrow/borrow-rate feeds and options flow, which often flag stress before headlines do.

- Low-float targets: He prefers names where a moderate surge in buying can move price a lot — the classic squeeze structure.

- Catalyst alignment: He combines macro triggers (like Powell) with company-level narratives (rate sensitivity, liquidity) to stack the odds.

That combo — macro + micro + options flow — explains why his calls keep getting traction and why traders rapidly pile in when he pings.

Final Take: A Lightning Rod for 2025’s Trading Frenzy

Whether one calls this genius, luck, or reflexive social trading, the fact is the market is listening. A dovish Fed turned a speculative itch into a feeding frenzy, and one well-timed alert made the move even faster. If you watched OPEN move from the low $3s into the $5s in a single session, you saw the mechanics in real time: macro catalyst → retail speculation → options gamma → forced cover → parabolic move.

This is an environment where timing, size, and nerves matter. The analyst thinks $7 is possible this week; the market will decide how credible that call is. Either way, few corners of retail trading will be able to look away.