“He’s Heating Up”: Grandmaster-Obi Nails $UUU at $4.85, Prints a Fast +34.8% — and Hints at a Fresh Leg for $CARM

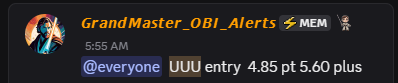

It’s starting to feel routine: Grandmaster-Obi drops a ping, and the tape does the rest. This morning (Tue, Sept 2, 2025), the M.E.M lead analyst alerted $UUU at $4.85; within hours the stock sprinted to an intraday high of $6.54 — a +34.8% pop before lunch. For traders who sized a quick $1,000 starter at the alert, that peak translated to roughly $1,348 at the high (before slippage/fees).

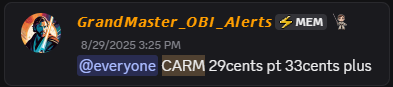

And remember Friday? His $CARM call at $0.29 ripped to $0.64 in about 30 minutes — a +120.7% burst that plastered screenshots across feeds going into the long weekend. As of this morning’s open, order-flow watchers inside the community say $CARM is showing the same telltale tremors — the kind that sometimes precede a second push. If momentum and liquidity line up, Tuesday could turn into another two-act session.

Why these keep working (in plain English)

Grandmaster-Obi’s playbook isn’t magic; it’s microstructure:

- Shorts under pressure: When the cost to borrow jumps or availability tightens, short sellers get uncomfortable — and buying to cover can snowball.

- Options “spark”: A rush of call buying forces market makers to hedge by purchasing shares, adding fuel to upside moves.

- Tight float: In names where the freely tradable supply is limited, even modest demand can move price disproportionately fast.

When all three show up together — as community scanners flagged on $UUU today and $CARM Friday — you get those quick, tradable bursts that define his feed.

Today’s tape: the quick math

$UUU

- Alert: $4.85 → High: $6.54

- Gain: +34.8%

- $1K at alert ≈ 206 shares → ≈ $1,348 at the high

$CARM (Fri recap)

- Alert: $0.29 → High: $0.64

- Gain: +120.7%

- $1K at alert ≈ 3,448 shares → ≈ $2,206 at the high

(Your fills will vary — peak prints are snapshots, not promises.)

What to watch next (if you’re stalking a “Round 2”)

- Borrow/locates: Rising borrow fees or tight locates can turn a slow grind into a sprint.

- Near-dated calls lighting up: Sudden volume in tight, near-the-money strikes is often the spark.

- Volume vs. average: Surges that dwarf 30-day volume can be the first domino.

- Ladders, not guesses: Many members use staged exits (+20% / +40% / runner with a trailing stop) to lock gains without over-thinking the top.

Bottom line

This piece is for information only, not financial advice. Short-cover and momentum trades are volatile and can reverse quickly; never risk money you can’t afford to lose.