How the “Roaring Kitty 2.0” Sparked a 225% MCVT Squeeze

In the crowded world of retail trading alerts, Grandmaster‑OBI has carved out a reputation for pinpoint accuracy—especially when it comes to stocks ripe for a short‑cover wave. Unlike the classic short squeeze, which often hinges on frenzied buying by retail eyes on a name, a short‑cover rally occurs when heavily shorted shares see forced buying by hedge funds and institutional short sellers covering their bets. Both can send a stock skyward, but short‑cover moves tend to be more methodical, driven by rising borrow costs and margin calls rather than pure retail mania.

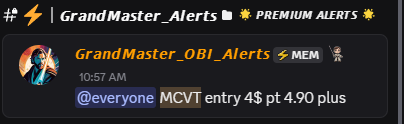

MCVT’s Meteoric 225% After‑Hours Jump

- Alert: July 25, 2025 @ $4.00

- After‑Market High: $7.53

- Gain: 225%

Today’s standout call was Mill City Ventures III (NASDAQ: MCVT). When OBI flagged it at $4.00, few traders had noticed a sudden spike in borrow rates—an early sign that short sellers were getting squeezed. By after‑hours trading, MCVT had surged to $12.98, in under 24 hours.

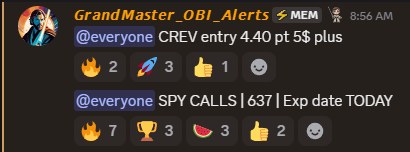

SPY Calls: Riding the Index Wave

- Alert: July 25, 2025 @ SPY $637 Calls @ $0.27 (27¢)

- Move: Spiked to $1.16 (116¢)

- Gain: +330%

Not one to overlook macro‑trends, OBI also pinpointed a burst in SPDR S&P 500 ETF Trust (SPY) call‑option buyers early this morning. With SPY trading around $634, the $637 strike calls were dirt cheap at 27¢. As the broader market rallied into midday, those same contracts shot up to $1.16, delivering a +330% return for nimble options traders.

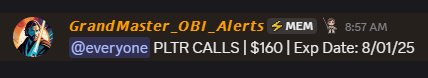

PLTR Calls: From In‑The‑Money to Skyward

- Alert: July 21 @ PLTR Aug 1 $160 Calls, underlying $151.98

- Peak Underlying Price: $160.39 (July 25)

- Gain: +85%+ on the August 1 $160 calls

Back on July 21, OBI identified Palantir Technologies (NYSE: PLTR) as a prime candidate for an options‑driven move and urged members to buy the August 1 $160 calls while PLTR was still trading below $152. Those contracts briefly went in‑the‑money when the shares hit $160.39 today—up over 85% since the alert—and OBI believes there’s still room to run toward $170 before expiration.

Why It Matters: The “Roaring Kitty 2.0” Distinction

Social media has begun dubbing Grandmaster‑OBI the “Roaring Kitty 2.0,” but there’s a crucial difference. While Keith Gill famously doubled down on GameStop, Obi’s approach is dynamic—he doesn’t fall in love with his picks. Once a target or catalyst has played out, he shifts focus to the next opportunity, keeping his community a step ahead of market cycles.

The Takeaway for Traders

- Short‑Cover Focus: Watch borrow rates and open interest for early signs of forced covering.

- Options Precision: Strike price selection and timing are critical—OBI’s SPY and PLTR calls show the power of strategic expiration targeting.

- Dynamic Strategy: Flexibility to move from one high‑conviction trade to the next keeps risk managed and returns amplified.

With today’s 12.98 on MCVT, +330% on SPY calls, and +85% on PLTR calls—all in a single week—Grandmaster‑OBI’s alerts continue to prove that a well‑appointed short‑cover strategy can outpace even the most legendary meme‑stock runs. For retail traders seeking consistent alpha, his real‑time signals are a must‑watch.

This article is informational only and does not constitute financial advice. Always conduct your own research or consult a licensed professional before trading.