MARKET EXPLOSION: Grandmaster-Obi’s Flash Alerts Ignite Triple Blasts — QMMM Rockets to $303, ISPC Tears to $3.69, GVH Doubles in Hours

Retail tape went volcanic again as Grandmaster-Obi dropped a stream of ultra-fast alerts that turned tiny entries into headline-making spikes. Traders woke up to jaw-dropping intraday moves across several tickers — and the percent math leaves no room for understatement.

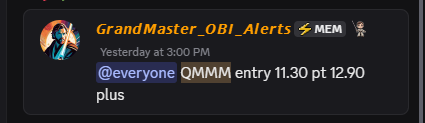

QMMM — $11.30 → $303 in about 24 hours → +2,581.42%

- Alert: $11.30 on 9/8/25 (community timestamp).

- Peak: $303.00 on 9/9/25.

- Percent gain (exact): ((303.00 − 11.30) ÷ 11.30 = 2581.4159…%** → ≈ +2,581.42%.

- What that looks like in cash (illustrative): $1,000 at $11.30 buys ≈ 88.50 shares → at $303 that position would be worth ≈ $26,815 (paper gain ≈ $25,815).

Why it mattered: QMMM’s overnight moonshot is the kind of vertical move that triggers trading halts, frenzied social sharing, and instant “did-you-get-in?” threads. When a name runs like that from a low-double-digit base into the triple hundreds, short-covering, retail FOMO and opportunistic algos combine into an explosive feedback loop — and Grandmaster-Obi’s timestamped call was the match.

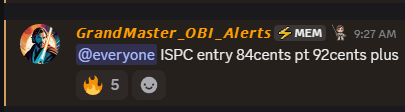

ISPC — $0.84 → $3.69 within hours → +339.29%

- Alert: $0.84 on 9/9/25 (this morning).

- Peak: $3.69 the same day.

- Percent gain (exact): ((3.69 − 0.84) ÷ 0.84 = 339.2857…%** → ≈ +339.29%.

- $1,000 scenario: $1,000 ÷ $0.84 ≈ 1,190.48 shares → at $3.69 ≈ $4,394 (paper gain ≈ $3,394).

Why it mattered: ISPC’s multi-bagger in hours is textbook short-cover/gamma reaction in a low-float name. Entry at under a dollar and a three-dollar-plus top in the same session creates the kind of viral screenshots that flood message boards and funnel even more traction to the alert origin.

GVH — $5.75 → $13.07 in ~2 hours → +127.30%

- Alert: $5.75 on 9/9/25.

- Peak: $13.07 roughly two hours after the ping.

- Percent gain (exact): ((13.07 − 5.75) ÷ 5.75 = +127.30%.

- $1,000 scenario: $1,000 ÷ $5.75 ≈ 173.91 shares → at $13.07 ≈ $2,272 (paper gain ≈ $1,272).

Why it mattered: GVH’s quick double-plus is a rapid, tradable spike that rewards speed and execution. Two-hour moves like this are exactly the kind of event traders trade live for — scalps, quick sell-offs, and laddered exits.

Why these moves are so combustible — and why Grandmaster-Obi’s pings get traction

Across QMMM, ISPC and GVH the same structural signature shows up repeatedly:

- Tight/limited tradable float — few freely tradable shares amplify buying pressure.

- Unusual options/call flow — big call blocks force market makers to buy shares (gamma hedging).

- Rising borrow costs / locate stress — shorts are vulnerable and can be forced to cover.

- A simple retail narrative or catalyst — a soundbite retail can rally behind and retweet.

Put those together, drop a real-time alert to a network of active traders, and minutes (or overnight) turn into multiple-hundred-percent moves. Grandmaster-Obi has been credited with consistently spotting that stack and time-stamping his reads — which is why screens fill with green so fast.

The controversy — loud wins, louder questions

When alerts and prints move this fast, controversy follows:

- Verification gap: Social screenshots of fills sometimes show prices different from consolidated tape peaks — and that fuels debate about who actually captured the highs and how representative community prints are.

- Velocity vs. sustainability: Explosive intraday spikes can reverse hard. Big winners on paper can evaporate if liquidity dries or dealer hedges unwind.

- Market structure spotlight: These moves expose how retail networks, options flow and hedging mechanics can interact to create outsized volatility — and that makes hedge funds, regulators and market-watchers pay attention.

It’s loud, messy, and sometimes spectacular. That’s the modern retail tape.

What traders are saying — and what you should do

Across Reddit/X/Discord the chorus is part awe, part caution: “He’s finding the right structures,” vs. “Peak prints don’t equal realized fills.” Practical points for anyone considering following such alerts:

- Size tiny, plan exits. Use starter sizes and ladder profits.

- Expect slippage. Not everyone gets peak prints. Execution and latency matter.

- Have stop rules. Quick spikes can retrace fast. Protect capital.

- Be skeptical and verify. Cross-check official tape if you’re going to risk real money.

Final snapshot — why this day will be remembered

Today’s slate — QMMM’s overnight parabola, ISPC’s hours-long pop and GVH’s two-hour double — reads like a retail-trading highlight reel. Whether one calls it orchestrated, structural, or simply a sequence of well-timed reads, the net effect is the same: green screenshots, viral threads, and an industry-wide conversation about how real-time social signals move markets.

This article reports on community-shared alerts and public intraday prints provided to the author. It is informational only and not financial advice. High-volatility trading can result in rapid losses; always do your own research and consider consulting a licensed professional before trading.