Market on Fire: Grandmaster-Obi’s Alert Streak — TURB, BREA, APLM Deliver Massive Moves

Retail traders woke up to another blistering session because one voice in the M.E.M. feed lit the fuse. Grandmaster-Obi — the lead alert analyst tied to the Making Easy Money (M.E.M.) community — put TURB, BREA and APLM on the radar this week, and each move has the same DNA: tight float, rapid options/flow activity, and retail momentum that compounds into parabolic price action. If the screenshots and time-stamped fills are to be believed, this is the kind of tape that changes accounts — fast.

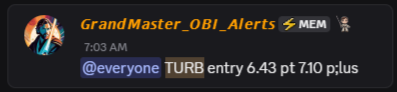

TURB: small entry → triple in hours

Alert: 9/16/25 — entry $6.43 (community alert).

Peak: a few hours later $19.74 (same trading day).

Result: roughly +207% intraday. A $1,000 starter at $6.43 would have been worth ~$3,070 at that peak — the kind of headline number retail channels screenshot and share. Public market pages and coverage also flagged a big Turbo Energy contract that day, a fundamental trigger traders cited as fuel for the move.

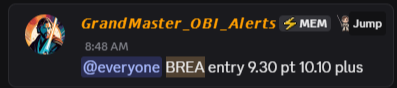

BREA: hour-long pop that turned quick cash into green

Alert: 9/16/25 — entry $9.30.

Peak: within about an hour $14.83.

Result: about +59% in under 60 minutes. That’s the type of short-window payoff that turns a $1,000 stake into roughly $1,595 at peak — instant profits for fast hands and disciplined exits. Market data shows heavy intraday volume on BREA the same session.

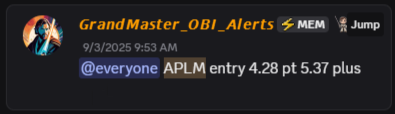

APLM: the multi-day runner that keeps giving

Alert: 9/3/25 — entry $4.28.

Peak (9/16/25): $12.50.

Result: roughly +192% over the multi-day run — a $1,000 starter at $4.28 would have been worth about $2,920 at the recent highs. Apollomics (APLM) sustained interest across sessions, drawing follow-through buying as momentum compounded.

Why these moves matter — the repeatable setup Grandmaster-Obi hunts

Observers who follow the live feed point to a simple, repeatable checklist that explains why these tickers catch fire:

- Constrained tradable float — few shares available to satisfy surging demand.

- Options and block-trade activity — concentrated call flow forces market makers to buy the underlying (gamma hedging).

- Borrow/locate pressure — short holders become exposed and may cover rapidly.

- A clean narrative or catalyst — a contract win, regulatory beat, or social buzz that retail can latch onto.

When those elements align and a timestamped alert drops into a fast, highly engaged chatroom, the result can be explosive — and that’s exactly what traders claim the M.E.M. stream has produced this week.

Social proof & momentum — why the feed amplifies itself

Two things make these alerts behave like a market accelerator:

- Speed: alerts are delivered live and often earlier than mainstream tickers, so a concentrated cohort can act quickly.

- Receipts: members post time-stamped fills and P&L screenshots; visible wins create urgency, which brings new buyers — and more price pressure.

M.E.M.’s channels and Grandmaster-Obi’s social handles have been central nodes in this cycle, and that social feedback loop is why new eyeballs keep arriving. The server’s growth — and the viral screenshots — are part of the same amplification engine.

What it means for traders (be smart, not reckless)

These headline gains are seductive — but they come with sharp caveats:

- Peak prints are snapshots. Not everyone captures intraday highs; slippage, fills and execution speed vary.

- Reversals can be immediate. Squeeze dynamics can unwind quickly if any leg of the thesis fails.

- Position sizing and exit rules are essential. Treat starter sizes and laddered exits as discipline, not hesitation.

If you’re watching the tape, treat the alerts as high-variance, time-sensitive opportunities. The community’s receipts show what’s possible — but risk controls are the difference between a screenshot and a realized win.

Bottom line — why Grandmaster-Obi’s voice is trending now

This week’s TURB, BREA and APLM sequences illustrate the repeatable microstructure Grandmaster-Obi says he hunts: real data, time-stamped alerts, and high-velocity execution by an engaged retail cohort. Whether one calls it a new playbook or a cyclical phenomenon, the market reality is clear: a well-timed alert in a low-float name can trigger outsized moves, and the M.E.M. stream has been a focal point for exactly those moments. If you want to watch the action live, that’s where the pings land first — but remember: speed without discipline is a fast way to lose.

This article reports on community alerts and public market prints. It is informational only and not financial advice. Rapid, speculative trading carries a high risk of loss — always do your own research and consider consulting a licensed professional before trading.