🔥 Reddit Trader Drops Triple Alerts — $3.48 → $23.29, $12.30 → $75 & Penny Pop Hits — Here’s What $1K Would’ve Become

Retail markets erupted again as Grandmaster-Obi's real-time pings set off three explosive premarket runs that have traders swarming his M.E.M. alert stream. Community time-stamps show the calls and the tape — tiny entries that printed massive intraday gains in hours or days. Below: the moves, the percent math, quick $1,000 scenarios, and why the Discord is filling up fast.

The tape — click-to-green winners (community-reported)

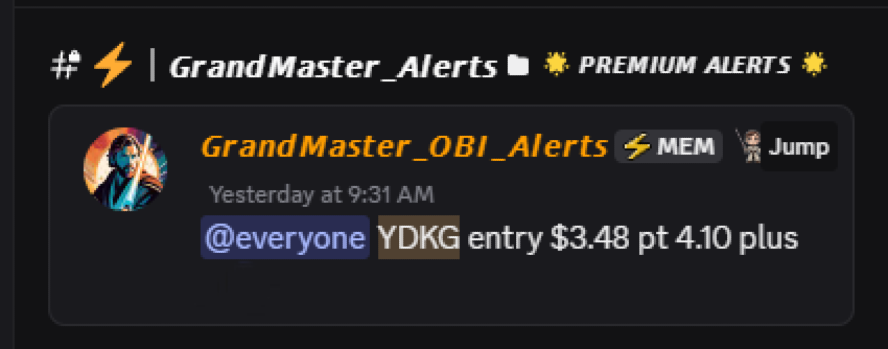

YDKG — $3.48 → $23.29 (alert 9/18/25; peak 9/19/25 premarket)

- Reported move: +≈569% in roughly <24 hours.

- $1,000 scenario: $1,000 ÷ $3.48 ≈ 287.36 shares → 287.36 × $23.29 ≈ $6,692.53.

That’s a paper jump from $1K to ~$6.7K in about a day if the community entry was captured at the stated level.

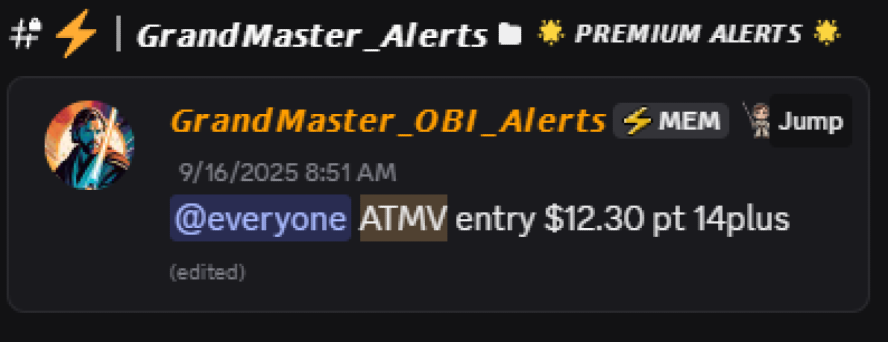

ATMV — $12.30 → $75.00 (alert 9/16/25; peak 9/19/25 premarket)

- Reported move: +≈510% in roughly three calendar days.

- $1,000 scenario: $1,000 ÷ $12.30 ≈ 81.30 shares → 81.30 × $75 ≈ $6,097.56.

A multi-day runner that turned modest stakes into a five-figure headline on paper.

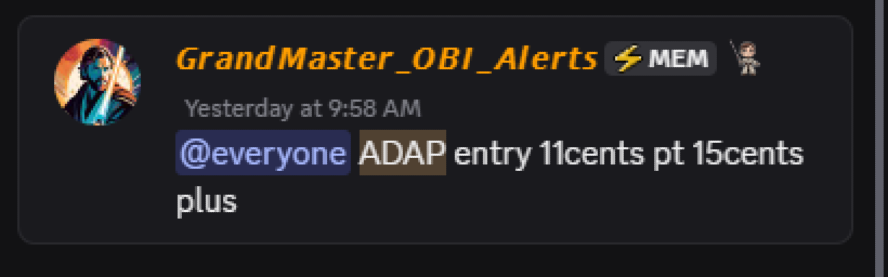

ADAP — $0.11 → $0.22 (alert 9/18/25; peak 9/19/25 premarket)

- Reported move: +100% within ~24 hours.

- $1,000 scenario: $1,000 ÷ $0.11 ≈ 9,090.91 shares → 9,090.91 × $0.22 = $2,000.

Microcap mechanics: tiny entry, doubled — and big percent headlines.

(All price/peak figures here are community-reported premarket/intraday prints circulated in M.E.M. channels and social feeds.)

Why these moves are happening — the repeatable playbook

Traders watching the M.E.M. feed say Grandmaster-Obi repeatedly hunts the same structural pattern that creates violent moves:

• Tight tradable float — few free shares makes each bid highly leveragey.

• Options/call sweeps — concentrated call buying forces dealers to buy the underlying (gamma buying).

• Borrow pain / locate stress — shorts squeezed into expensive positions get forced to cover.

• A simple, viral narrative — a clean story retail can retweet and pile into.

When those four pieces click, the tape can go vertical fast. The stream drops a time-stamped entry and the community acts — the loop amplifies itself: alert → fills → screenshots → more buyers.

Why traders are flooding the Discord now

- Real-time receipts. Members post time-stamped fills and P&L screenshots immediately after alerts; that social proof brings more eyeballs fast.

- Actionable context. Alerts are frequently accompanied by brief rationale—borrow reads, options flow, and suggested bet sizing—so the signal isn’t just a ticker, it’s a playbook.

- Speed matters. In micro-float squeezes minutes make the difference between an OK fill and a life-changing print. The M.E.M. feed specializes in that first-wave timing.

Quick reality check — what the receipts don’t show

- Snapshots over outcomes: intraday peaks quoted in chat are peak prints — many members don’t realize the absolute top. Execution, slippage and spreads matter.

- High variance: these setups can reverse violently; what looks like a miracle one minute can be a fast retracement the next.

- Verification gap: community screenshots and consolidated tape sometimes differ; always cross-check public prices before acting.

Bottom line — why this cycle keeps growing

Whether one calls it luck or pattern recognition, the result is the same: repeated high-variance wins create viral proof and net new members. Grandmaster-Obi’s stream pairs rapid alerts with microstructure reasoning and time-stamped evidence — and that combination is what’s filling the M.E.M. channels right now. If you saw the screenshots this morning, you saw why traders are leaning in — fast entries, explosive percent moves, and a leaderboard of headline prints.