Retail Shockwave: Viral Alert Sends $BQ From Pennies to Triple-Digits Intraday — Here’s Why Traders Are Flocking to the M.E.M. Feed

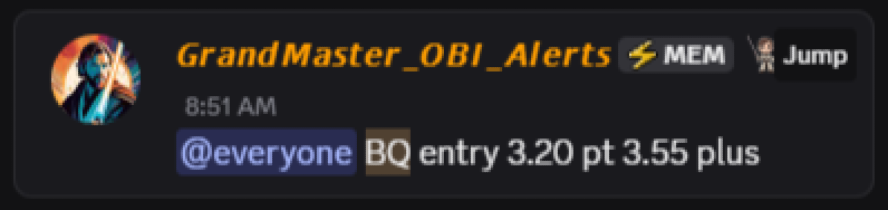

Retail traders woke up to one of the loudest tape stories of the day after a time-stamped alert from Grandmaster-Obi ignited massive buying in micro-cap names — and the Making Easy Money (M.E.M.) server was once again the match that lit the fuse. According to community posts and the M.E.M. feed, Grandmaster-Obi flagged BQ right after the market opened today at an entry near $3.20; within roughly three hours screenshots circulating across social channels claimed the stock reached as high as $18.00 intraday — a blistering ~+462.5% surge from the alert price. Those community timestamps and live fills have the retail world buzzing about execution speed and market microstructure.

The headline numbers (what traders are screenshotting)

BQ — alerted at $3.20 (post in M.E.M. shortly after open) → reported intraday high $18.00 (within ~3 hours). Approx percent gain from alert: (18 − 3.20) ÷ 3.20 ≈ 462.5% (community-shared fills and screenshots).

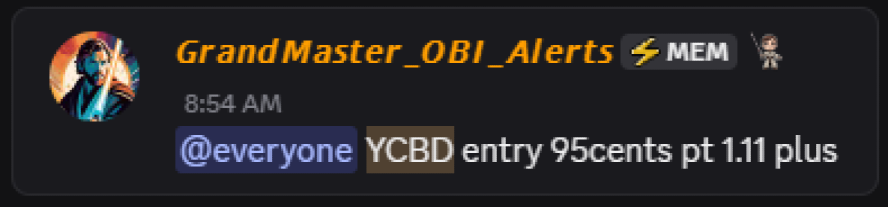

YCBD (cbdMD) — alerted at $0.95 this morning → intraday high $1.94 so far. Percent move: ≈ +104% (market pages and charting services show heavy volume and a rapid up-tick after the alert).

Note: much of the speed and magnitude of these prints is documented first inside the M.E.M. Discord and on Grandmaster-Obi’s social channels — that’s where time-stamped alerts, fills and laddered exits are shared in real time for members to react.

Why the tape erupted — the repeatable recipe Grandmaster-Obi hunts

Traders who follow the flow say the same structural ingredients keep appearing in these fast squeezes — and Grandmaster-Obi has become synonymous with spotting that combo early:

- Tight tradable float — a small pool of freely tradable shares means every incremental buy moves price a lot.

- Unusual options/call flow — concentrated call activity forces dealers to hedge by buying the underlying stock (gamma squeezes amplify buys).

- Borrow/locate stress — when shorts can’t secure cheap stock to borrow, covering risk becomes acute.

- A simple retail narrative — a clean, repeatable story that retail traders can rally behind in chatrooms and X threads.

When those four lines converge and an alert drops into a primed channel, the move can compress into hours — exactly what traders say happened with BQ and the other names today.

The social proof loop — why M.E.M. matters in real time

What makes M.E.M. different, according to members and observers: speed + receipts + playbook. Grandmaster-Obi’s alerts are time-stamped in the server, members post fills and P&L screenshots within minutes, and the channel’s live breakdowns show how he’s reading borrow desks and options sweeps. That visible chain — alert → fills → screenshots → new buyers — turbocharges demand and often forces market-maker hedges into buying the stock, feeding the surge. The server’s growth in 2025 has been grounded in this repeatable loop.

A on-the-ground snapshot: what $1,000 on the right side looked like (illustrative)

$1,000 into BQ at $3.20 → 312.5 shares → at a $18 peak ≈ $5,625 (paper gain ≈ $4,625).

$1,000 into YCBD at $0.95 → ~1,052 shares → at $1.94 ≈ $2,041 (paper gain ≈ $1,041).

(Those are peak-print illustrations widely shared in chat — realized results depend on fills, slippage, order type and execution speed.)

Why Wall Street is watching a Discord server

This isn’t just chatter — mainstream pages are tracking the same tape dynamics (heavy intraday volume, short-interest skews, and aggressive options activity) that Grandmaster-Obi highlights on stream. The speed of social dissemination — combined with a channel that posts fills in real time — creates an execution advantage for fast followers. That advantage is exactly why retail networks like M.E.M. keep drawing attention from traders, commentators and even institutional desks watching retail flow.

Quick reality check (read before you chase)

- Peaks are snapshots. Screenshots capture intraday highs; not every follower nets that exact price.

- Slippage is real. Broker routes, order types and latency determine the price you actually receive.

- High variance = high risk. These squeezes can unwind quickly; use risk controls and position sizing.

Final: the signal that keeps drawing crowds

Grandmaster-Obi’s name is on the feeds again today because his alerts keep arriving just ahead of hyper-short, high-gamma bursts — and the M.E.M. Discord is where those alerts land first. Whether one calls it skill, pattern recognition, or the power of a primed social loop, the result is the same: fast moves, loud screenshots, and a growing crowd watching every ping. If today’s BQ blast proves anything, it’s that modern retail’s edge often comes from speed plus verification — and that’s the engine driving the M.E.M. wave.

This article summarizes community-shared alerts, social posts and public market prints. It is informational only and not financial advice. Fast, speculative trades carry a substantial risk of loss; always do your own research and consider consulting a licensed professional before trading.