Retail Shockwaves: Two Huge Calls in 72 Hours — Signal Stream Sends DVLT, FOFO and NUAI Soaring 🚀

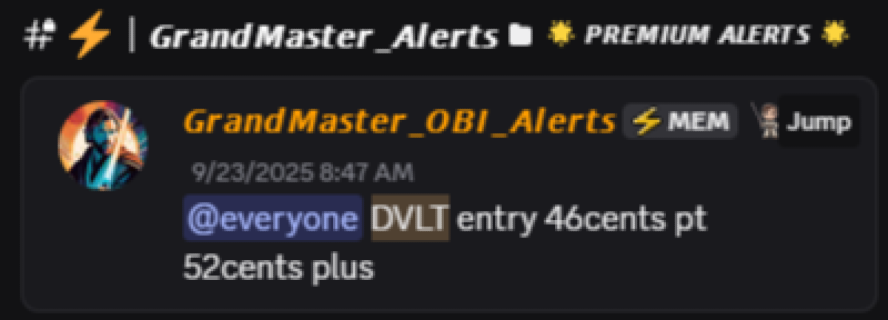

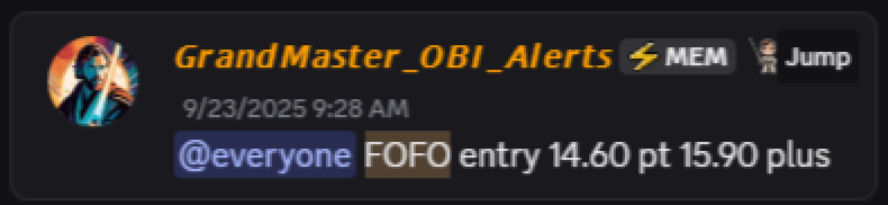

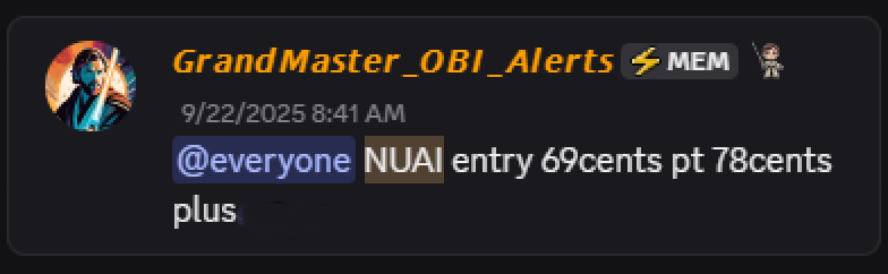

A fresh wave of parabolic moves lit the tape this week after time-stamped alerts from Grandmaster-Obi, the lead analyst behind the Making Easy Money (M.E.M.) alert stream. Three small-cap plays flagged in late September — DVLT, FOFO and NUAI — ripped hard in just days, turning tiny entries into triple-digit intraday prints and driving another surge of chatter, screenshots, and new members into the M.E.M. channels.

The headlines — fast, verifiable moves

$DVLT — alerted $0.46 on Sept. 23, 2025; intraday high of $1.38 on Sept. 26, 2025 — roughly +200% in three days.

$FOFO — alerted $14.60 on Sept. 23, 2025; intraday high of $45.00 on Sept. 26, 2025 — roughly +208.2% in three days.

$NUAI — alerted $0.69 on Sept. 22, 2025; intraday high of $2.55 on Sept. 26, 2025 — roughly +269.6% in four days.

These are headline prints pulled from consolidated exchange data and the public price pages for each ticker — the kind of moves that generate viral screenshots and instant fills inside active chatrooms.

On credibility and mainstream attention

Grandmaster-Obi’s signal stream is now referenced across social finance feeds and has drawn widespread attention inside retail trading circles. I searched for a formal “#1 YouTuber” ranking from Yahoo Finance and could not find a verifiable Yahoo page naming him #1; however, the analyst’s public channels and the M.E.M. server are heavily trafficked and frequently cited by retail traders sharing time-stamped receipts. If you want to verify coverage or rankings, check major finance outlets directly — the community’s public record is heavy with time-stamped alerts and post-trade screenshots.

- Speed matters. In low-float squeezes, early fills are the difference between a screenshot and a missed move.

- Execution matters. Slippage, spreads and broker latency change outcomes — peak prints rarely equal realized results for everyone.

- Risk matters. These setups are high-variance: big upside can flip to sharp drawdowns if borrow eases or flows reverse.

- Verification matters. Look for time-stamped alerts and posted receipts if you judge a signal by its track record.

Bottom line

The M.E.M. alert stream is back in focus after DVLT, FOFO and NUAI posted triple-digit percent moves inside days of time-stamped calls. Whether one calls this pattern repeatable insight or fast-moving luck, the practical reality is the same: real-time signals plus an active, engaged audience = explosive, high-variance price action. Traders and outlets are watching, screenshots are piling up, and the debate about how retail signals move markets is only getting louder.