Retail Signal-Slinger Sparks Multi-Bagger Frenzy — Here’s Why Traders Are Flocking to the M.E.M. Alerts

Retail-market chatter hit fever pitch today after a fresh string of time-stamped alerts from Grandmaster-Obi, the lead analyst behind the Making Easy Money (M.E.M.) alert stream. In just hours, multiple tickers ripped higher — and social feeds filled with screenshots, time-stamped fills and “did you see this?” threads. Below: the tape, the math, and why so many traders are clicking into the M.E.M. feed right now.

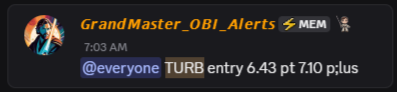

The morning scorcher: $TURB

Alert: TURB at $6.43 (Sept. 16) → Peak: $20.45 (a few hours later).

That’s roughly a +218% intraday surge from the cited entry to the reported high. The run was covered widely across market wires and niche outlets as an outsized volatility event tied to sudden news flow and heavy retail buying interest. Market chatter and screenshots flooded social channels within minutes.

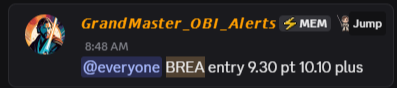

Fast follow-up: $BREA

Alert: BREA at $9.30 (Sept. 16) → Peak: $14.84 (within about an hour).

That’s about +59.6% from alert to peak — a sharp single-session pop that pushed Brera into many intraday top-lists and headlines. Exchange and finance pages logged the spike as part of a wave of small-cap volatility that morning.

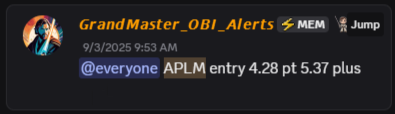

The multi-day runner: $APLM

Alert: APLM at $4.28 (Sept. 3) → Peak: $12.98 (11 trading days later, still printing gains on Sept. 16).

That’s an approximate +203% multi-day advance from the M.E.M. entry — a textbook “swing-run” that rewarded early entrants and kept momentum players active across sessions. Public price histories show APLM trading up strongly over the period.

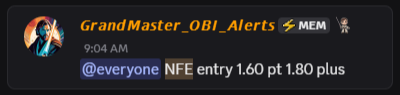

The quick double: $NFE

Alert: NFE at $1.60 (Sept. 16) → Peak: $2.72 (same session).

That’s a +70.0% pop in hours — the kind of fast, tradable move that scalpers and short-cover traders live for. Broader energy and infrastructure headlines helped amplify the move.

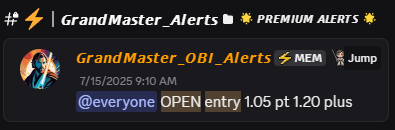

The long-view win: $OPEN

Alert: OPEN at $1.05 (July 15) → Peak: $10.97 (Sept. 11).

That’s a staggering +877.6% from the early alert to the multi-week top — an example M.E.M. members point to when discussing the feed’s longer-horizon, high-conviction calls. Opendoor’s multi-session rally drew mainstream coverage for its meme-stock dynamics and leadership developments, and the channel’s follow-ups and video commentary have been watched closely by traders tracking the tape.

Why the M.E.M. signal stream moves markets

The feed’s believers point to a repeatable, structural playbook behind each major call:

- Microstructure first: tight tradable float and borrow pressure create an environment where concentrated buy flow or options activity forces hedges and short covering.

- Options & gamma: unusual call activity often precedes rapid buy flows as market-makers hedge, pushing shares higher.

- Narrative + execution: each alert is delivered with a short, viral-friendly narrative that mobilizes quick retail response — then the stream’s real-time pings amplify the effect.

- Receipts: members frequently post time-stamped fills and laddered exit screenshots — the social proof that brings more eyeballs and liquidity into the tape.

That chain reaction — structural stress + concentrated flow + social amplification — is the core reason multiple tickers can rip in rapid succession when the same signal operator pings the network.

The video that has traders rewinding

This morning the lead analyst behind the M.E.M. stream dropped a new OPEN update video that traders are treating like a tactical playbook. The short, focused breakdown walks through option strikes, timing windows, and where the analyst expects dealer hedging to add fuel — plus clear stop and scaling guidance. For traders who want context (not just a ticker and an entry), that video is the reason many people tune in live and watch the tape with the server feed on. The video is publicly posted and circulating in the community.

Community reaction — why the server is swelling

The M.E.M. server shows high member activity and has been one of the busiest retail hubs this cycle. Users point to three practical advantages:

- Speed: real-time alerts with time stamps — minutes matter.

- Transparency: members share fills and exits, creating a public track record that fuels conviction.

- Education: video breakdowns and risk-management talk (size, scale, stops) make the stream useful for traders trying to learn the mechanics behind fast runs.

A straight-up reality check

This is high-volatility, high-risk trading. Intraday peaks are snapshots — not everyone captures the highs shown in screenshots. Slippage, execution, and order type make a huge difference. Fast winners can reverse quickly. Treat any alert as a high-variance idea, size conservatively, and use explicit exit plans. This coverage is informational, not financial advice.

Final word

Whether you call it pattern recognition, market microstructure mastery, or simply being in the right place at the right time, the M.E.M. stream and its lead analyst have delivered a sequence of fast, notable moves across TURB, BREA, APLM, NFE and OPEN — and traders are paying attention. For those who want context with their alerts — time-stamped calls, video walk-throughs and rapid verification from fellow members — the channel has become a magnet for active, tape-watching traders.

This article reports on public price prints, community-shared alerts and publicly posted videos. It is informational only and not financial advice. Rapid, speculative trading carries the risk of total loss; always do your own research and consider consulting a licensed professional before trading.