🔥 Retail Tornado: Grandmaster-Obi’s STEC Call Blasts Off — +440% in Hours

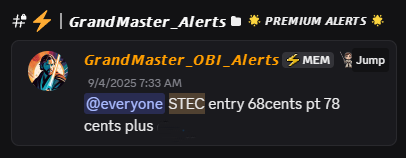

Grandmaster-Obi lit up the tape again — his Santech Holdings (STEC.US) alert from 9/4/25 at $0.68 printed an intraday peak of $3.67 on 9/8/25, a blistering ~+440% move that flooded feeds with screenshots and green fills. Traders across Reddit, X and the M.E.M. channels exploded with reaction — and the momentum didn’t stop there.

Quick hit — recent breakout alerts and peak moves tied to his stream:

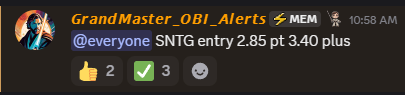

- SNTG — alerted $2.85 (9/8) → peak $12.70 today. ~+345%.

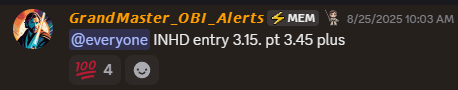

- INHD — alerted $3.15 (8/25) → peak $15.90 (9/8). ~+405%.

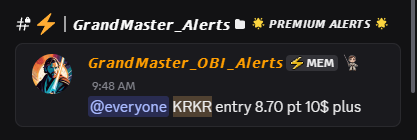

- KRKR — alerted $8.70 (9/8) → peak $21.36. ~+146%.

- LDI — alerted $2.00 (9/3) → peak $4.03 (9/8). ~+101%.

- SOGP — community entry ~$6.00 → mid-$30s peak in early Sept. +500%+.

Why the frenzy? The common signature behind these calls: tight tradable float, concentrated options/call flow, borrowing pressure on shorts and a clean narrative that retail can rally behind. Put those together and dealer hedging + retail FOMO can compound into parabolic runs — the exact structural setups Grandmaster-Obi hunts and timestamps in real time.

The social engine matters: timestamped pings, in-chat fills, and live breakdowns create a feedback loop — more eyeballs, faster moves. M.E.M. has become the hotbed where these signals drop first; that speed advantage is the difference between a decent fill and a headline screenshot.

Reality check: dramatic intraday peaks are snapshots. Slippage, execution and fast reversals are real risks. This is speculative, high-volatility action — not a guaranteed strategy.

Want real-time pings and the behind-the-scenes readouts that triggered these moves? Watch the live breakdowns and time-stamped alerts — the tape has been answering, again and again.

This article reports on community-shared alerts and intraday prints. It is informational only and not financial advice. High-volatility trading carries significant risk; always do your own research.