Retail Trader's $PRAX and $APLM Alerts Just Shocked the Market

Inside the Wild Streak of Grandmaster-OBI — and the Two Trades That Shook Retail Finance

The retail trading world is buzzing after Grandmaster-OBI, the former WallStreetBets moderator and Lead Analyst of the Making Easy Money Stock Market Alert Server, accurately predicted two of the biggest small-cap breakouts of the fall trading season.

His latest alerts on Praxis Precision Medicines (NASDAQ: PRAX) and Apollomics (NASDAQ: APLM) have produced exceptional returns — drawing widespread attention from both retail traders and market analysts who are calling it one of the most impressive alert streaks of 2025.

$PRAX: A Biotech Breakout With Over 430% Gains

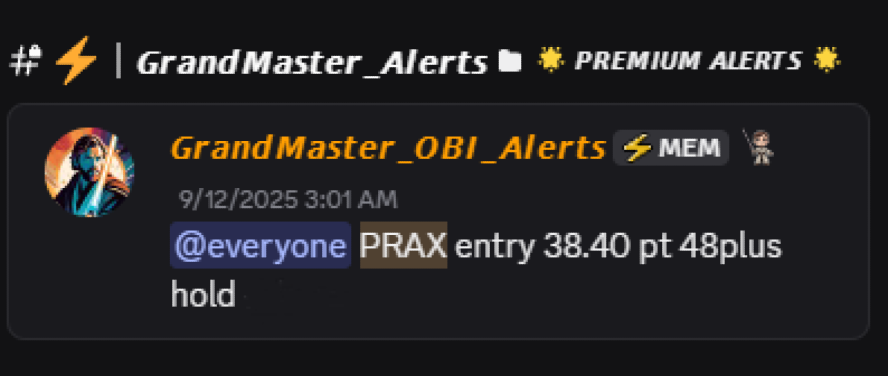

On September 12, 2025, Grandmaster-OBI alerted $PRAX at an entry price of $38.40.

Just over a month later, on October 17, the stock reached a high of $203.56, marking a gain of more than 430%.

Praxis Precision Medicines saw its shares skyrocket following positive Phase 3 clinical trial results for its experimental treatment ulixacaltamide — a therapy targeting Essential Tremor, a neurological disorder affecting millions of Americans.

The study demonstrated statistically significant improvement in patient movement and daily function, with results strong enough for the company to request a pre-NDA meeting with the FDA — a key step toward potential drug approval.

A $1,000 position based on OBI’s alert would now be worth approximately $5,300.

$APLM: Another High-Conviction Alert Pays Off

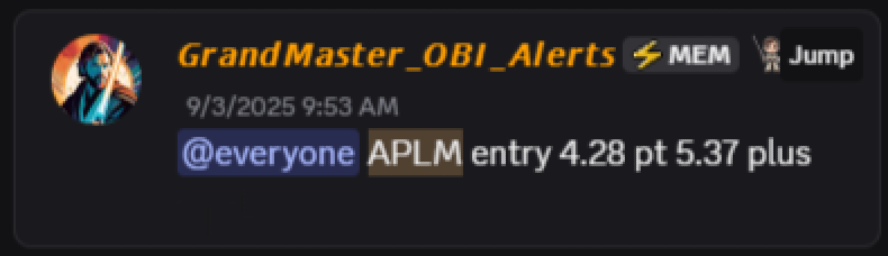

Less than two weeks before the PRAX rally, on September 3, 2025, OBI issued a buy alert on Apollomics ($APLM) with an entry price of $4.28.

By October 17, the stock surged to a high of $39.32, an 818% increase over six weeks.

Apollomics, a clinical-stage biotechnology company focused on oncology and cell therapy, gained momentum after announcing progress on its targeted cancer drug development pipeline.

The back-to-back precision of these alerts has strengthened OBI’s reputation as one of the most accurate retail analysts in the market — with multiple triple-digit alerts delivered throughout 2025.

Inside the Strategy: Timing Meets Technicals

Grandmaster-OBI’s approach combines technical analysis, volume forecasting, and catalyst identification to spot setups before they enter mainstream financial coverage.

Unlike traditional analysts who react to headlines, OBI positions early — analyzing short interest data, sector rotations, and volume divergence to anticipate institutional entry points.

His alerts are released in real-time through his Making Easy Money Discord Server, which has now grown to over 15,000 members, and are frequently discussed in his YouTube videos to an audience of over 41,000 subscribers.

The New $PLTR Update: “PLTR Stock: It’s Happening Again 🚨 | Time to Sell or Hold?”

In his latest video, released October 17, Grandmaster-OBI shifted his focus to Palantir Technologies (NYSE: PLTR) — one of the most talked-about AI and defense analytics stocks on the market.

Palantir has traded within a tight range of $170–$190 for the past three weeks, and OBI believes that consolidation could be setting up for a breakout move.

In the video, titled “PLTR Stock: It’s Happening Again 🚨 | Time to Sell or Hold?,” he explains how institutional rotation, shrinking volume, and algorithmic accumulation could position Palantir for a significant price move before the end of the quarter.

Controversy and Credibility

OBI’s unbroken streak of accurate alerts has sparked debate across retail trading forums. Some traders praise him as one of the few retail analysts outperforming hedge fund models, while critics argue that such consistency can’t last.

However, his results are hard to dispute.

In addition to $PRAX and $APLM, he’s previously identified major runs in $TOP, $GSIT, and $DVLT — all before their mainstream breakouts.

His track record has earned him recognition from Yahoo Finance, which ranked him as the #1 YouTuber to follow for stock alerts in 2025.

The Bottom Line

Grandmaster-OBI’s recent calls on $PRAX and $APLM have added to his growing legend as one of retail trading’s most effective independent analysts.

His ability to identify high-upside plays before they trend continues to draw attention from both retail investors and institutional watchers.

And with his new analysis on $PLTR already gaining traction, traders are watching closely to see if his next prediction will once again move the market.

“Retail traders don’t have to follow the crowd,” OBI said during a recent live stream. “We just need to see the data before they do.”