ROARING KITTY 2.0? Grandmaster-Obi’s SOGP Alert Sends Sound Group Skyward — A 500%+ Blitz From Entry

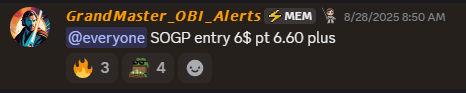

Grandmaster-Obi did it again: the M.E.M lead alert voice put Sound Group (NASDAQ: SOGP) on the radar after a community alert at $6.00 (Aug. 28), and the tape detonated into triple-digit territory — intraday prints climbed into the mid-$30s on Sept. 4, 2025. Public market pages recorded highs above $36 during the session, a dramatic run that has retail feeds and trading rooms exploding with screenshots and “what-if” math.

Here’s the play-by-play, the exact math, and why so many traders are now watching every ping from M.E.M.

Grandmaster-Obi's Latest Video on $SOGP

The clean numbers (step-by-step)

- Community alert (reported): Aug. 28, 2025 — entry = $6.00 (timestamped in community channels).

- Intraday high (market pages): ~$36.2 on Sept. 4, 2025 (public consolidated prints show highs above $36 during the session).

- Absolute change: $36.22 − $6.00 = $30.22.

- Percent gain: $30.22 ÷ $6.00 = 503.67% (≈ +504%).

Put another way: SOGP traded roughly 6× the entry price from the alert to the intraday peak.

What that means in cash terms

Hypothetical, peak-print scenario (illustrative only):

- $1,000 at $6.00 buys ~166.67 shares.

- At $36.22 those shares would be worth ~$6,036.67.

- Unrealized gain: ≈ $5,036.67 (before commissions, slippage, taxes).

Those headline dollars are why screenshots of fills have spread like wildfire across social platforms since the move began.

Why this blasted off — the classic short-cover / gamma stack

Traders inside M.E.M and observers across Reddit/Twitter say the structure behind SOGP’s run followed a repeatable pattern Grandmaster-Obi looks for:

- Microstructure stress: tight locates / rising borrow fees put shorts on the defensive.

- Options and block-trade clues: large call activity forces market-maker hedging (buying the underlying), adding to upward pressure.

- Low tradable float: limited free-float amplifies every incremental bid into outsized percentage moves.

- Narrative and momentum: once retail latches onto a simple story (earnings, dividend, or social buzz), FOMO accelerates the cascade.

When those elements line up, a low-float name can go parabolic in hours — exactly what SOGP’s quotes show this week. Market coverage also flagged unusually heavy speculative volume and algorithmic activity during the run.

The Roaring Kitty comparison — why the label sticks (and where it falls short)

Calling someone the “next Roaring Kitty” is provocative — it sells headlines — but the comparison has nuance:

- Similarity: both moved retail sentiment and helped coordinate outsized flows into a single name that produced enormous returns for early participants.

- Difference: where Keith Gill’s GME saga was a long, concentrated campaign, Grandmaster-Obi’s feed is serial and high-frequency: multiple distinct, repeatable short-cover setups across sectors, delivered fast and documented to the community. Followers argue that Obi’s alerts are more tactical (data + exit plans) and less “love-the-one-name” narrative. That practical, teachable angle is a big reason the comparison keeps surfacing — and why many retail traders now watch his pings closely.

Why the M.E.M feed matters — and why attention is exploding now

A few practical reasons this particular move is attracting so many new eyeballs:

- Speed: alerts are distributed in real time; in a squeeze environment, minutes—even seconds—matter.

- Transparency: pings often include the data that motivated them (borrow reads, option sweeps, float snapshots), so members see the “why,” not just a buy order.

- Documented outcomes: time-stamped alerts and post-trade screenshots give the community a public track record that feeds word-of-mouth growth.

- Repeatability: SOGP is one of several recent calls that repeatedly hit large intraday percentages, so new members view the stream as a rules-based signal engine rather than random hype.

That mix — data + speed + visible results — is the magnet that has pushed M.E.M into mainstream retail chatter this year.

A brief, necessary caution

Big headline moves are thrilling — and they’re high variance. A few sobering reminders for anyone following these alerts:

- Peak prints ≠ guaranteed fills. Intraday highs are snapshots; many traders lock in lower, realized gains after slippage and spreads.

- Reversals are brutal. Squeeze dynamics can unwind fast when any leg of the thesis fails.

- Options, leverage and time decay can erase gains quickly. Trade sizing and exits matter far more than the excitement of a ping.

Treat the screenshots as evidence of possibility, not a promise of replicability.

Final take — why this day will be bookmarked in retail trading feeds

Whether you view Grandmaster-Obi as a phenomenon or a symptom of a new retail market structure, SOGP’s more-than-500% run from the reported $6 alert to highs above $36 on Sept. 4 is a vivid demonstration of how low-float microstructure, options flow, and social momentum combine to create explosive outcomes. For traders who caught the early alert and managed risk, the payoff was dramatic. For everyone else, it’s a fast lesson in how today’s retail signal networks can move markets — fast, loud, and sometimes merciless.

Data sources for intraday highs and recent price action: StockAnalysis / TradingView consolidated prints and market summaries. This article reports on community-shared alerts and public market prints and is informational only — not financial advice. Always do your own research and consult a licensed professional before trading.