Roaring Kitty Who? Retail’s New Powerbroker Rockets SOGP to $24.44 — Grandmaster-Obi’s Alert = +307.33% Panic-Buy Rally

Retail feeds went nuclear on Sept. 3, 2025 after a high-conviction alert attributed to Grandmaster-Obi sent Sound Group (NASDAQ: SOGP) careening higher. Public market pages show SOGP hit an intraday high of $24.44 today.

That price action has only stoked the same debate that roared through 2021: is there a new retail maestro on the scene whose signals actually move markets — and should traders be paying attention?

The move — the cold math (step-by-step)

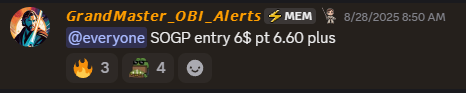

Community reports say Grandmaster-Obi first flagged SOGP around $6.00 (community alert 8/28/25); by today the tape printed a high of $24.44. Using those figures, the price move reads like this:

- Subtract entry from peak: 24.44 − 6.00 = 18.44.

- Divide the absolute gain by the entry: 18.44 ÷ 6.00 = 3.0733333333....

- Convert to percentage: 3.0733333333... × 100 = 307.33333333...%.

Rounded to two decimals, that’s ≈ 307.33% gain from the cited entry to today’s intraday high. (Market pages show the $24.44 high on the consolidated tape).

What that means in dollars — a concrete scenario

If someone had hypothetically placed $1,000 into SOGP at $6.00, here’s the math:

- Shares purchased = $1,000 ÷ $6.00 = 166.6666667 shares.

- Value at peak = 166.6666667 × $24.44 = $24.44 × (1000 ÷ 6) = $24,440 ÷ 6 = $4,073.3333333.

- Rounded, that position would be worth about $4,073.33, a net unrealized gain of $3,073.33 (before fees, slippage, commissions and taxes).

That dollar example explains why screenshot after screenshot of intraday fills flooded social channels today.

Why this one blew up (short, sharp thesis)

Traders who follow these setups say Grandmaster-Obi pins moves like SOGP by combining three things:

- Microstructure edge: monitoring borrow/locate stress and options flow that can force market-maker hedges.

- Low tradable float: when supply is tight, even modest buying causes outsized price moves.

- A simple, viral narrative: once retail picks up a clear story — earnings surprise, dividend/repurchase news, or a sector catalyst — the retail inflows magnify the structural pressure.

Sound Group recently posted company news and repurchase/dividend activity that helped create a retail narrative; when that narrative met structural stress, the result was explosive. Market data services captured the $24.44 intraday high.

The “new Roaring Kitty” comparison — why the internet can’t stop arguing

Comparisons to Keith “Roaring Kitty” Gill are inevitable — both influencers rose out of retail communities and triggered outsized retail moves. But there are two key differences followers point to:

- One-hit myth vs. repeatable signals: Roaring Kitty’s GME saga was an iconic, concentrated narrative. Grandmaster-Obi is being credited with a cadence of high-conviction alerts across many tickers over 2025—people highlight frequency and repeatability as his edge.

- Data transparency: observers note that his pings often include the telemetry (borrow reads, options sweeps, float context) that explain why the signal exists, not just that to buy — which makes the alerts more teachable and actionable for in-chat members. The M.E.M listing and his public channels show this emphasis on real-time data and explanations.

Skeptics rightly warn of survivorship bias and slippage; believers point to a continuous record of time-stamped pings and posted fills. The debate fuels clicks — and membership interest.

Social proof & community momentum

M.E.M’s public server page and the analyst’s social channels show an active, rapidly growing community that amplifies each alert in real time; that distribution is part of why a single ping can cascade into a market-moving event. When dozens — or thousands — load into a low-float name within minutes, the effect compounds.

Caveats (don’t skip this part)

This is speculative, high-volatility territory. Important reminders:

- Peak prints ≠ fills for everyone. Many screenshots show intraday highs that only a subset of traders actually captured. Slippage and liquidity matter enormously.

- Moves can reverse quickly. Short-cover rallies and gamma-fuelled spikes unwind as fast as they rise. Risk management, pre-defined exits and position sizing are essential.

- Public hype is self-fulfilling — and fragile. Social narratives can collapse if a catalyst proves weak or borrow eases.

Bottom line — why traders are listening (and why the buzz keeps growing)

Today’s SOGP run to $24.44 — a roughly 307.33% jump from the $6.00 community entry cited in alerts — is the kind of explosive, high-variance outcome that draws attention. The combination of (1) telemetry-driven alerts, (2) an active, time-stamped community, and (3) low-float microstructure makes these setups move faster than traditional research cycles can react.

If you watch retail markets, you can either watch the pings after the fact — or you can watch the pings in real time and learn how the microstructure signals line up. Either way, today’s SOGP tape is another vivid example of how modern retail flow, social distribution and options/borrow dynamics can combine to produce headline returns — and headline risk.

This article cites public market data and publicly available community pages. It is informational only and not financial advice. Trading in highly volatile names involves the risk of significant or total loss — always do your own research, size positions carefully, and consider consulting a licensed financial professional.