The Former WallStreetBets Mod Who Just Turned a $4 Stock Into $12.98 Overnight—And He's Not Slowing Down

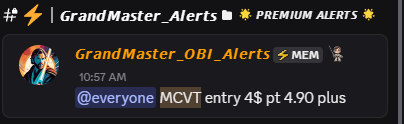

Traders are accustomed to volatility, but few have matched the precision and consistency of Wallstreetbets former Mod G.M.O, now the Lead Alert Analyst at the M.E.M Discord Server. On July 25, he issued a real‑time signal on Mill City Ventures III (NASDAQ: MCVT) at $4.00, and by after‑hours trading, the share price had rocketed to $12.98—a 225% leap in under 24 hours. This remarkable move is just the latest in a string of high‑conviction calls that leave both retail speculators and institutional desks scrambling to keep up.

A Meteoric Move: The MCVT Breakdown

- Alert Issued: July 25, 2025, 10:15 AM ET @ $4.00

- After‑Hours Peak: $12.98 (July 25)

- Raw Gain: +225%

If you’d placed a $1,000 stake at the alert price, you would have acquired 250 shares—worth $3,245 at the peak, netting a $2,245 profit before fees. A $10,000 position would have ballooned to $32,450, demonstrating the outsized returns possible when the right squeeze setup is exploited at exactly the right moment.

The Man Behind the Alerts: From Meme‑Stock Moderator to Squeeze Specialist

Before adopting the G.M.O moniker, this analyst honed his skills as a volunteer moderator on WallStreetBets, where he co‑streamed alongside Keith “Roaring Kitty” Gill during the GameStop saga. Those livestreams, which dissected real‑time order‑flow and community sentiment, provided an early education in the mechanics of meme‑drives and gamma squeezes. Today, he applies that same analytical rigor to pinpointing stocks on the brink of a short‑cover wave, rather than relying on viral hype alone.

Understanding the Short‑Cover Wave vs. Short Squeeze

Retail traders often conflate short squeezes—where enthusiastic buyers trigger a feedback loop of forced cover—with short‑cover waves, which are typically more nuanced and driven by institutional margin calls:

- Short Squeeze: Retail‑driven frenzy (e.g., GME) where large buy orders and social‑media momentum create rapid price jumps.

- Short‑Cover Wave: Hedge funds and professional shorts, facing rising borrow costs and margin pressures, scramble to close positions, fueling sustained upward moves.

MCVT epitomized a textbook short‑cover wave: an early spike in borrowing fees, followed by systematic dealer hedging as he and his team tracked large call‑option sales and elevated open interest.

The Trigger Points That Made MCVT Explode

- Borrow‑Rate Surge: Data feeds showed MCVT’s cost to borrow shares climbed above 40% APR days before the alert—an unmistakable red flag for risk managers.

- Options‑Flow Clues: Block trades in out‑of‑the‑money $5 and $7 calls hinted at institutional interest, forcing market makers to buy the underlying equity as a hedge.

- Float Dynamics: With fewer than 20 million shares freely tradable, even modest coordinated buying pressure sent price action parabolic.

These elements aligned perfectly: he pounded the virtual table with a Discord ping, and the community followed, turning a handful of data points into a multi‑hundred‑percent gain.

A Broader Track Record: Not Just a One‑Off

MCVT joins a long list of G.M.O’s high‑octane winners this year:

- TDTH (Trident Digital Tech): $0.28 → $2.68 (+857%)

- GCTK (Glucotrack): $5.40 → $12.29 (+128%)

- DFLI (Deflecto): $0.19 → $0.67 (+253%)

- OPEN (Opendoor Tech): $1.05 → $4.97 (+373%)

- AIRE (reAlpha Tech): $0.23 → $0.98 (+326%)

- PLTR Calls (Aug 1 $160 Strike): Underlying $151.98 → $160.39 (+85% on contracts)

Time and again, G.M.O has demonstrated the ability to surface short‑cover setups days before traditional research desks—combining macro insights, technical triggers, and on‑chain borrow analytics.

Community Reaction and Social‑Media Buzz

- On Reddit, megathreads dissected the MCVT move in real time, with members posting fill screenshots and P&L striations.

- Twitter saw the hashtag #MCVTSqueeze trending among finance influencers, sparking debates about how far a micro‑cap can rise.

- Stocktwits channels lit up with bullish and contrarian takes, though the majority of sentiment skewed overwhelmingly positive.

Commenters marveled at the speed: “I got the alert at 10:15, filled at 4.05, and five minutes later my screen was green 100%,” one member wrote.

What’s Next on the Radar?

Fresh rumors swirl around other high‑borrow names like Rocket Companies (RKT), which he hinted could see a $25 squeeze if borrow fees stay elevated. Meanwhile, new institutional filings and call sweeps in early‑stage biotech tickers suggest he already has his sights set on the next short‑cover candidate.

The Edge That Keeps Funds Awake at Night

Hedge funds dread being caught on the wrong end of these moves. When G.M.O pings a high‑confidence setup, the sheer speed and focus of retail-turned‑semi‑institutional buying can overwhelm any repo desk. And in a market where milliseconds matter, having the first mover advantage—alongside live tools for borrow rates and options-flow—can be the difference between a standard return and a life‑altering windfall.

Bottom Line: As whispers of his next call spread, the question among seasoned traders isn’t “Can I afford to enter?” but rather “Can I afford to miss this?”

This article is for informational purposes only. Always conduct independent research or consult a licensed professional before making trading decisions.