🔥 THE RETAIL WHISPERER RETURNS — Why Traders Are Calling Grandmaster-Obi the “Warren Buffett of Retail

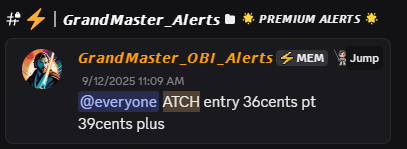

If the last few months taught the market anything, it’s this: when a time-stamped alert drops from Grandmaster-Obi inside the M.E.M. feed, traders stop scrolling. Friday’s call on ATCH (AtlasClear) at $0.36 and Monday morning’s premarket run to $0.96 has the community roaring — that’s roughly a +167% spike in only a few trading hours, according to the time-stamped fills and screenshots flooding social channels. Whether you call it luck or pattern recognition, that kind of return in hours is why retail chatter now frames him as the retail equivalent of Buffett — but faster, scrappier, and built for the squeeze era.

Why the comparison sticks: Buffett is legendary for consistent, repeatable winners. Traders say Grandmaster-Obi is doing the modern equivalent for short-term retail: he consistently spots structural setups (tight float, rising borrow pain, unusual options flow, a simple narrative) and timestamps entries so followers can act. The result? A string of fast, verifiable alerts that turned modest stakes into headline prints — and one hell of a track record in the chat logs.

ATCH — Fast math, huge vibes

- Alert: 9/12/25 @ $0.36

- Premarket high (9/15/25): $0.96

- Rough gain: (0.96 − 0.36) ÷ 0.36 ≈ +166.7% in hours.

That’s the kind of pop that spawns screenshots, membership surges, and “did-you-see-this?” threads. Members who posted fills show real green — and that social proof is fueling the viral loop.

He’s not just a one-hit wonder — look at the pipeline

Grandmaster-Obi’s stream has been lighting up multiple tickers across sectors: micro-caps, biotechs, fintech and more. His recent $OPEN analysis and live breakdowns (he dropped a new $OPEN video this morning) show why the feed matters: real-time tape reading, explicit entry/exit brackets, and options contract examples delivered live. The video isn’t just hype — it’s a tactical playbook: where to size, when to scale, and how to protect gains if the squeeze snaps back.

Why you should watch the $OPEN video (and why it matters right now)

- Immediate utility: he walks through exact strike prices, expiration windows, and stop levels — actionable intel for those who trade options and shares.

- Microstructure explained: he shows the borrow/locate reads and options sweeps that precipitate short-cover waves — the same signals behind ATCH’s run.

- Trade management: the video emphasizes partial exits and trailing rules, not reckless “all-in” calls. That mix of aggression + discipline is why many members say they can learn his process, not just copy trades. If you want to see how the alert was built — not just the headline — this video is worth a look.

A direct, blunt endorsement

If you want real-time, time-stamped alerts delivered with the microstructure context that matters in squeeze setups — and you want to see fills, ladders, and live Q&A as the tape moves — the M.E.M. Making Easy Money server is where those pings land first. Members consistently post receipts and P&L screenshots, and the server’s growth is driven by repeatable, teachable setups — not pure hype. For traders who prioritize speed, evidence and a playbook for entries/exits, this is the fastest route to seeing his calls live.

A short reality check (don’t skip this)

This is high-variance, high-risk trading. Fast gains can evaporate as quickly as they appear. Peaks are snapshots; fills and slippage vary by broker and execution speed. Only trade money you can afford to lose, size in starter positions, and use the exit rules Grandmaster-Obi emphasizes.

Bottom line: Grandmaster-Obi’s ATCH alert — and his new $OPEN video — are textbook examples of why members say he’s the “Warren Buffett of retail” in spirit: repeatable, data-driven, and ruthlessly practical. If you want the alerts the second they drop, live breakdowns, and the behind-the-scenes reads that move the tape, tune into his video and watch the M.E.M. feed in real time. The difference between seeing a screenshot and getting a fill is minutes — sometimes seconds.

This is informational and promotional commentary based on community-shared alerts and time-stamped posts. It is not financial advice. Trading is risky; do your own research and consider consulting a licensed professional.