The Tape Is On Fire: Grandmaster-Obi’s Alert Streak Sends Small Caps Soaring — INHD, SOGP, KRKR and LDI Deliver Monster Moves

Retail markets woke up again today to another barrage of explosive moves after a string of real-time alerts from Grandmaster-Obi, the high-velocity signal voice tied to the M.E.M. alert stream. In the past two weeks his pings on SOGP, OPEN and INHD grabbed headlines — and today several follow-ups exploded: INHD vaulted, KRKR ripped, and LDI doubled. The numbers are eye-watering, the screenshots are viral, and traders are calling this the hottest streak of the retail era.

Quick scoreboard (exacts and math)

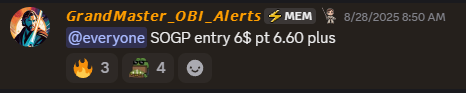

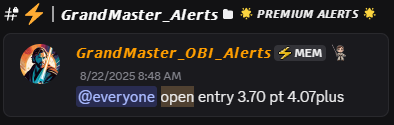

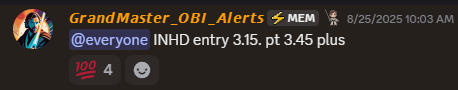

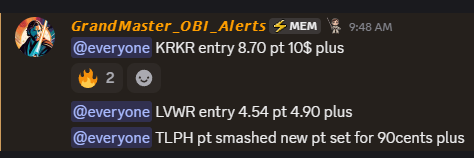

Below are the entry/peak numbers being circulated in community channels and the exact percent math — the kind of headline returns cropping up in feeds this morning:

- SOGP (Sound Group) — community alert entry $6.00 (Aug. 28). Reported intraday peak ~$37 (early September sessions). That’s roughly +516.7% from entry to peak; a $1,000 stake at $6 would have been worth ~$6,166.67 at the peak (≈ +$5,166.67 unrealized).

- OPEN (Opendoor) — early alert around $3.70 (late Aug). Recent intraday moves into the mid-$6s have been widely covered by mainstream outlets as retail regained appetite for rate-sensitive names. A jump to $6.85 equates to +85.1% from $3.70; $1,000 at $3.70 → ~$1,851.35 at the peak. MarketWatch and other outlets have chronicled the frenzy around OPEN’s rally and heavy retail participation.

- INHD (Inno Holdings) — alerted $3.15 (Aug. 25 at 10:03 AM, community timestamp). Today (Sept. 8) intraday prints ran to $15.90, a +404.76% surge from entry. A $1,000 position at $3.15 would have been worth ~$5,047.62 at that peak (≈ +$4,047.62). Official price histories for INHD show material intraday volatility in recent sessions.

- KRKR (36Kr Holdings) — alerted $8.70 this morning (Sept. 8, 9:48 AM, community timestamp). The name printed an intraday high of $21.36 — that’s +145.52%. Hypothetical $1,000 put into KRKR at $8.70 would be ~$2,455.17 at the peak (≈ +$1,455.17). Public tickers show KRKR trading surges this week.

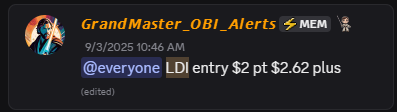

- LDI (loanDepot) — community alert entry $2.00 (Sept. 3). As of Sept. 8 the stock touched $4.03, a +101.5% run; $1,000 at $2 would have been ~$2,015.00 at that high. Historical LDI data confirms heavy trading and multi-session pops this week.

(Calculations above are straightforward: percent = (peak − entry) / entry × 100; $1,000 scenario = $1,000 ÷ entry × peak — illustrative peak-print math, not guaranteed realized results.)

What’s behind the surge — the “short-cover + gamma” engine

These rapid squeezes aren’t random. Traders and on-chain market watchers point to the same repeating signature that Grandmaster-Obi emphasizes in his alerts:

- Borrow / locate stress: highs in short borrow fees or constrained locates make shorts vulnerable.

- Unusual options flow: big near-dated call sweeps force market-makers into delta/gamma hedging (i.e., buying the stock).

- Tight tradable float: a shallow free float magnifies every incremental buy.

- A retail-friendly narrative or catalyst: an earnings beat, sector buzz, macro tailwind, or social viral loop that brings new buyers.

When those four legs align, the result is exactly what feeds and screenshots are showing: fast, outsized percentage moves that compress into hours or days. Grandmaster-Obi’s public channels (YouTube/X) and the M.E.M feed have been repeatedly flagging names where these signals converge.

Why traders are flooding the chat — speed and receipts

Two practical reasons the community reaction snowballs:

- Latency advantage: early pings delivered in real time matter in micro-float squeezes — being the first wave separates decent fills from life-changing ones.

- Visible verification: members post time-stamped fills and P&L screenshots after calls; that public trail builds momentum and more eyeballs.

That social feedback loop — alert → fills → screenshots → more buyers — is the modern retail amplifier. It’s why one alert can cascade into a multi-session phenomenon.

A mainstream nod — what the press is saying (and what I could verify)

Opendoor may be drawing in new bears even as the stock rallies. This is why, says @S3Partners https://t.co/XgEP08cxJo via @MarketWatch #Opendoor $OPEN

— James Rogers (@jamesjrogers) September 8, 2025

Mainstream outlets have been tracking the underlying market moves that underpin these alerts: Opendoor’s recent rally drew coverage about heavy retail flows and short-interest dynamics that make it a high-volatility battleground.

The reality check — what every trader needs to remember

For every screenshot of a perfect fill, there are traders who missed the peak, got poor fills, or were squeezed by snapbacks. A few hard truths:

- Peak prints are snapshots. Not everyone captured the intraday highs shown in screenshots; slippage and spreads matter.

- Reversals are brutal. Gamma squeezes and short-cover waves can reverse rapidly when a leg of the thesis weakens (borrow eases, option flows normalize, or a negative headline appears).

- Risk and execution matter more than hype. Use pre-defined sizing, laddered exits, and trailing stops if you’re participating — don’t chase a headline.

This is high-variance trading: the upside can be huge, but the downside is very real.

Final: why this moment matters

Whether one believes these moves are systemic evidence of a new retail playbook or just episodic mania, the practical outcome is the same: real money changed hands, real accounts flashed green on screenshots, and retail signal operators like Grandmaster-Obi are shaping where short-cover pressure and gamma fuel concentrate. For traders watching the tape, that means speed, discipline, and risk controls — the mechanics of the game have evolved, and the market is answering in real time.

This article reports on community-shared alerts, public market prints and mainstream coverage of market mechanics. It is informational and not financial advice. Rapid, speculative trades and options carry significant risk of loss; always do your own research and consider consulting a licensed financial professional before trading.