The Trader Everyone’s Calling “Roaring Kitty 2.0” — How Microcaps Are Exploding

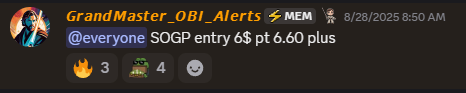

A seismic move in small-cap land: Grandmaster-Obi — the lead alert voice behind the M.E.M. alert stream — put Sound Group (SOGP) on the radar at $6.00 (community alert on Aug. 28), and traders are now circulating screenshots showing an intraday peak of $29.52 on September 3, 2025. That’s a jaw-dropping move that lit up Reddit and X timelines and refueled the “Roaring Kitty 2.0” debate around who now moves retail markets. (Consolidated exchange data also shows very large intraday highs for SOGP in recent sessions — public quote pages and market sites recorded multi-dollar rallies around the same dates).

The clean math — exactly how wild this run was

All arithmetic done step-by-step:

- Entry (community alert): $6.00

- Peak (reported intraday): $29.52

- Absolute change: $29.52 − $6.00 = $23.52.

- Percent gain: $23.52 ÷ $6.00 = 3.92 → 3.92 × 100 = 392.0%.

Put another way, SOGP multiplied ~4.92× from entry to peak (29.52 ÷ 6.00 ≈ 4.92). If a trader placed $1,000 at the $6.00 alert (fractional shares allowed), the peak value would be:

- Shares bought = $1,000 ÷ $6.00 = 166.6667 shares.

- Value at $29.52 = 166.6667 × $29.52 ≈ $4,920.00.

- Net unrealized gain: ≈ $3,920 (before commissions, slippage, taxes).

That’s the kind of ferocious multiple retail chatrooms are screenshotting right now.

How the move unfolded (what traders say happened)

Members who track Grandmaster-Obi’s signals point to a repeatable pattern:

- Microstructure stress: borrow fees and locate tightness show shorts are uncomfortable.

- Options/flow spark: unusual call sweeps force market-maker hedges (they buy the stock), amplifying moves.

- Low free float: limited shares amplify every incremental buy into big percentage jumps.

- Narrative + momentum: once retail sees a clear, easy story (earnings, sector momentum, or social buzz), FOMO compacts the move into hours or days.

SOGP’s late-August → early-September surge fits that checklist: elevated interest + tight supply + concentrated buying that cascaded into parabolic intraday prints across venues. Public market pages recorded dramatic intraday ranges and large volume spikes during the move.

Why traders compare Grandmaster-Obi to Roaring Kitty — and why the comparison keeps evolving

People love labels. The “Roaring Kitty” comparison keeps coming because both figures moved markets — but the parallels and contrasts matter:

- Similarity: Both influenced retail behavior and helped coordinate large, concentrated flows into individual tickers that produced outsized returns for early participants.

- Difference #1 — Breadth: Roaring Kitty’s era centered on one iconic, sustained narrative (GME). Grandmaster-Obi’s stream is more serial — he pings multiple high-conviction setups across sectors, producing repeatable, high-frequency opportunities.

- Difference #2 — Data transparency: Followers say Obi’s alerts often include the data behind the call (borrow reads, call-sweeps, float analysis), so members see the why — not just a buy command.

- Difference #3 — Trade management: Community pings commonly include suggested sizing, scaling and exit ideas, which many retail traders find more operational than purely inspirational calls.

The comparison fuels conversation, but it’s the repeatable pattern recognition and real-time delivery that’s driven Obi’s recent traction. His YouTube/X footprint and community pings make it easy for traders to verify alerts and outcomes in near real time.

The social effect — why the M.E.M. feed is swelling with eyeballs

When a name jumps 392% from a public entry alert, new eyeballs arrive fast. A few practical reasons the M.E.M server has been expanding:

- Speed of delivery: alerts and the data behind them arrive in real time — that latency advantage matters in squeeze setups.

- Public verification: members post timestamped fills and screenshots, creating a visible track record that builds momentum.

- Repeatability: traders who saw earlier winners (multi-day blasts like RGC, HWH, SOGP earlier swings, etc.) are more likely to watch the next ping closely.

That dynamic creates a feedback loop: accurate calls attract members → members create more buying pressure on targets → alerts become more consequential — which is why retail chatter about SOGP moved quickly from whisper to wildfire.

A fair reality check — what the screenshots don’t show

Before you get swept by FOMO, remember:

- Peak prints are snapshots. Intraday highs aren’t the fill price everyone captured. Slippage, spreads and speed matter.

- Reversals happen fast. Squeeze and momentum plays can snap back if borrow eases or options flow cools.

- Risk management is essential. Position size, staging exits, and stop discipline are the difference between a lucky screenshot and a realized win.

If the SOGP run teaches anything, it’s that rapid gains are possible — but only with a stack of structural signals, good timing, and disciplined trade management.

Bottom line — why traders are leaning in now

Grandmaster-Obi’s SOGP call (entry cited at $6.00) translated into a community-reported intraday peak at $29.52 — a +392% leap that turned $1,000 into roughly $4,920 at the extremum. Whether you interpret that as an extraordinary signal, a market anomaly, or both, the practical reality is this: a systematic scan for borrow stress, options flow, and float compression — delivered instantly — is reshaping how some retail traders hunt for outsized trades. The M.E.M. stream has been a focal point for that work, and SOGP’s surge is the latest, loudest example.

This article reports on community-reported alerts, public market prints, and observable market mechanics. It is informational only and not financial advice. Rapid, speculative trading carries a high risk of loss; always do your own due diligence and consider consulting a licensed financial professional before trading.