Traders Demand Answers 🚨 Grandmaster-Obi’s Calls Spark Frenzy — APLM Rockets, BREA & AGMH Explode, Traders Demand Answers 🚨

Retail markets erupted again this week after a fresh wave of time-stamped alerts from Grandmaster-Obi, the former WallStreetBets moderator whose M.E.M. alert stream has become the lightning rod for rapid, high-variance pop trades. What started as a cluster of tactical pings turned into halted tape, viral screenshots, and angry chatter about market fairness — all while early entrants on the alerts watched eye-watering percentage gains.

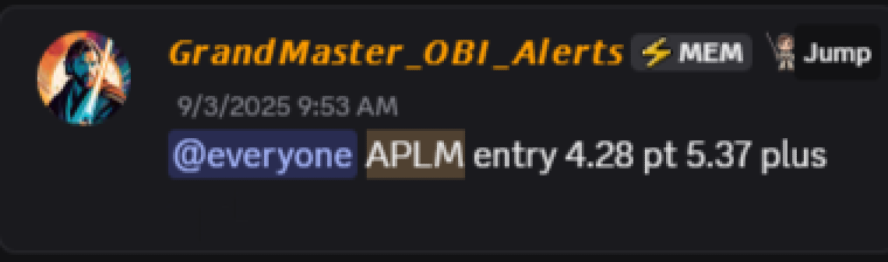

APLM — Alerted at $4.28 (9/3/25) → Peak near $20.98 (9/16/25) — ≈ +390%

Apollomics vaulted into the headlines after being flagged by Grandmaster-Obi early in September. The name went on a multi-day runner and printed triple-digit intraday moves; consolidated tape later showed highs above $20 and Nasdaq issued a formal trading halt the following day as it sought additional information from the company. Traders across social channels say the call was time-stamped and precise — and they flocked to the stock in droves.

Why this matters: a near-four-hundred-percent move in days (and a halt the next session) is the kind of market event that forces conversations about retail speed, liquidity, and how modern flows interact with exchange mechanics. The halt — confirmed by Nasdaq — added fuel to community outrage and curiosity.

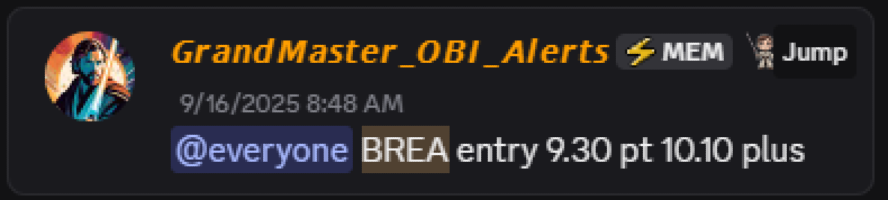

BREA — Alerted at $9.30 (9/16/25) → Peak near $52.95 (9/18/25) — ≈ +470%

Brera Holdings’ rally rapidly accelerated after a Grandmaster-Obi ping on Sept. 16. Over the next sessions, the company announced a blockbuster PIPE/restructuring plan and rebranding that ignited an enormous retail bid, sending the stock sharply higher and producing one of the more dramatic multi-day percentage moves of the week. News releases and market pages reported the company’s $300M PIPE and rebranding plans that coincided with the spike.

Why this matters: when a corporate catalyst (PIPE + rebrand) lines up with retail momentum and an active signal network, moves can be violent and fast — creating winners, but also raising questions about market structure and information flow.

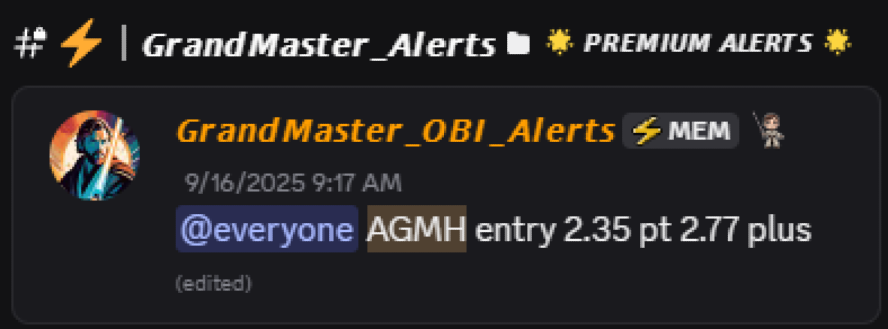

AGMH — Alerted at $2.35 (9/16/25) → Peak near $6.25 (9/18/25) — ≈ +166%

AGM Group ran hard after being flagged mid-week, recording strong intraday gains as buyers responded to the alert and ensuing social amplification. Streaming chatrooms and time-stamped fills show members piling into the name as momentum compounded across sessions. Real-time quotes and market pages captured the surge.

Why this matters: AGMH’s run is typical of the short-cover + gamma pattern Grandmaster-Obi often highlights: concentrated buying in a name with limited tradable supply produces outsized percent moves in short order.

The flashpoint — short squeeze target video, a halted tape, and trader fury

The sequence that most stoked controversy began when Grandmaster-Obi posted a video naming APLM as a short-squeeze candidate. Within hours the tape accelerated, the stock leapt into the double digits, and Nasdaq stepped in with an official halt to request more information — a move that, to many retail traders, looked like the exchange intervening in the middle of a retail-driven rally. Nasdaq’s halt notice (and the differing prints circulating in social posts) set off a storm of accusations: screenshots of fills versus consolidated tape, claims of missed fills, and calls for transparency.

Analysts and market-structure observers note that halts are routine when exchanges need additional corporate information — but for communities experiencing life-changing paper gains on the way up, a halt becomes a lightning rod for grievance and theorycraft. The fallout has made this particular run one of the most widely discussed retail episodes of the month.

What’s driving these repeated, violent moves? The signal stack.

Across APLM, BREA, and AGMH the same structural factors recur — the elements Grandmaster-Obi has publicly said he tracks:

• Tight tradable float (small available supply)

• Unusual call-option activity (concentrated flows that force dealer hedging)

• Borrow/locate stress (shorts are vulnerable when locate windows tighten)

• A clean, meme-able narrative or corporate catalyst that retail can rally around

When these four pieces align and a time-stamped alert drops into a highly engaged audience, the result can be explosive. Market makers hedge, shorts cover, and retail FOMO accelerates the move — often within hours or a few trading sessions.

The social proof loop — why the M.E.M. feed amplifies moves

The modern retail amplifier is simple: alert → fills → screenshots → social amplification → more buyers. Members post receipts in real time; influencers clip highlights; trending posts drive the next wave of buyers — and that feedback loop is precisely why a single time-stamped call can snowball into multi-day rallies. M.E.M.’s public channels have been full of time-stamped fills tied directly to these calls.

Reality check — wins don’t erase risks

This surge cycle has produced spectacular paper gains — and equally spectacular risks. Key cautions for anyone watching:

• Peak prints are snapshots. Not every viewer captures intraday highs.

• Slippage and execution matter. Broker type, order routing and latency change outcomes.

• Reversals are real. Fast squeezes and gamma runs can unwind brutally if flows change.

• Verification gaps exist. Social screenshots sometimes differ from consolidated tape; that fuels controversies around fills and fairness.

Treat these alerts as high-variance events, not guarantees.

Final take — why this story won’t die anytime soon

Grandmaster-Obi’s stream is a live case study of how social signals, options flows and low float names interact in 2025’s retail market. The APLM halt, BREA’s massive POP tied to corporate news, and AGMH’s rapid climb are all symptoms of that new environment — and they’ve turned a single analyst’s alerts into front-page social conversation, regulatory questions, and loud debates over market fairness.

This article summarizes public market prints, exchange notices and community-shared alerts. It is informational and not financial advice. Rapid, speculative trading and options strategies carry significant risk of loss; always do your own research and consider consulting a licensed financial professional before trading