Two Explosive Penny Stocks That Just Doubled and Tripled: $GWH and $ELBM Surge After Early Alerts

The fall trading season has been anything but quiet, as two small-cap stocks — ESS Tech (NASDAQ: $GWH) and Electra Battery Materials (NASDAQ: $ELBM) — delivered massive percentage gains over the past week.

At the center of the action is the M.E.M Stock Market Alert Server Lead Analyst, a well-known retail trader and former WallStreetBets moderator, recently ranked #1 by Yahoo Finance as the most accurate YouTuber to follow for daily stock alerts.

His latest callouts have once again sparked conversation among traders about how retail-led communities continue to spot momentum before Wall Street analysts catch on.

🚀 $GWH ESS Tech (GWH.US) — +661% in One Week

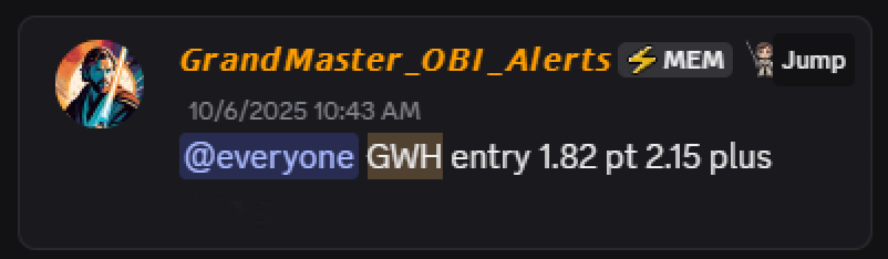

On October 6, the M.E.M Analyst alerted ESS Tech (GWH) for an entry price of $1.82.

Within just a week, the stock skyrocketed to a high of $13.87 on October 13, marking a jaw-dropping +661% gain.

ESS Tech’s rally has drawn renewed interest from traders betting on renewable energy storage technologies, especially as the company’s long-duration iron-flow batteries gain traction in the U.S. grid modernization movement.

But for the M.E.M community, this move was another confirmation of precise timing and momentum tracking.

⚡ $ELBM Electra Battery Materials (ELBM.US) — +274% in Five Trading Days

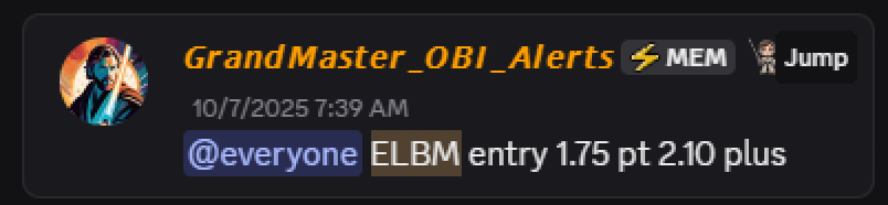

Just one day after the GWH alert, on October 7, the M.E.M Analyst spotlighted Electra Battery Materials (ELBM) at an entry of $1.75.

By October 13, the stock had surged to $6.55, representing a +274% gain in under a week.

The company, a key player in North America’s growing battery materials supply chain, has seen renewed speculative momentum as investors position ahead of upcoming policy incentives tied to domestic EV production.

For short-term traders, this was another textbook breakout that the M.E.M community caught early.

💰 What These Alerts Mean for Traders

These back-to-back moves come as part of a long streak of well-timed alerts from the M.E.M Stock Market Alert Server, which now hosts over 15,000 active members across its live channels.

Followers credit the lead analyst’s success to his ability to identify low-float momentum setups with volume confirmation, often hours or days before they appear on mainstream market scanners.

A hypothetical $1,000 investment in each of these two alerts would have grown to:

- $7,610 in GWH (+661%), and

- $3,740 in ELBM (+274%),

for a combined total of $11,350 — a +278% average return in one week.

🧠 The Formula Behind the MEM Analyst’s Success

The M.E.M Analyst’s approach blends:

- Technical breakouts with confirmed volume surges

- Short-interest tracking to predict potential squeezes

- Sector rotation analysis to identify overlooked plays in energy, AI, and biotech

This disciplined blend of data and retail momentum scanning has made his YouTube and Discord communities some of the fastest-growing in the retail trading world.

⚠️ The Volatility Factor

While the results are impressive, traders are reminded that penny-stock volatility cuts both ways.

Stocks that surge several hundred percent in a week can retrace quickly.

Proper risk management, stop-loss placement, and independent research remain critical to long-term trading success.

This article is for informational purposes only and should not be considered financial advice.

✦ The Takeaway

Whether these moves mark the start of a broader rally in energy-related small caps or just another week of retail-led breakouts, one thing is certain — the retail crowd isn’t going anywhere.

And the M.E.M Stock Market Alert Server Lead Analyst continues to prove that with timing, discipline, and the right community, independent traders can still outpace Wall Street.